- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Intro, Legal and Cap Structure 06/12/21

Receivables 06/12/21

Yielding Assets 06/12/21

Cash Flow 06/12/21

Build to hold 06/12/21

Investment Discussion 06/12/21

Build to sell 06/12/21

German Real Estate

Adler are iteratively refinancing first their 1L and now their 1.5L bonds - the latter with a new 10% PIK at 0.75% OID. The 1.5L is de-risking from the refinancing of the

Details of the refinancing are emerging. As management had previously indicated, the NRW portfolio has now been sold to OneIM and Orange Capital Partners, expected to be effective in stages from 31st of January. The transaction value is significantly below our

Adler have secured commitments for the refinancing of the 1L PIK loan via a new €1.2bn 8.25% (1% OID) loan, a transaction that is to save the company nearly

Adler, now under Karl Reinitzhuber, are out this morning with a presentation that largely only documents the restructuring we all have already

Various asset sales: LEG, who already hold the minority share, today announced the acquisition of most of Adler's stake in Back. The price accurately reflects our

Perhaps Adler has a better chance of refinancing more of that First Lien debt now that S&P are raising their rating. We are holding on to our

Even though we felt comfortable with Adler’s financial statements throughout the entire episode - never mind some of the (legal) abuse of standards) - we are

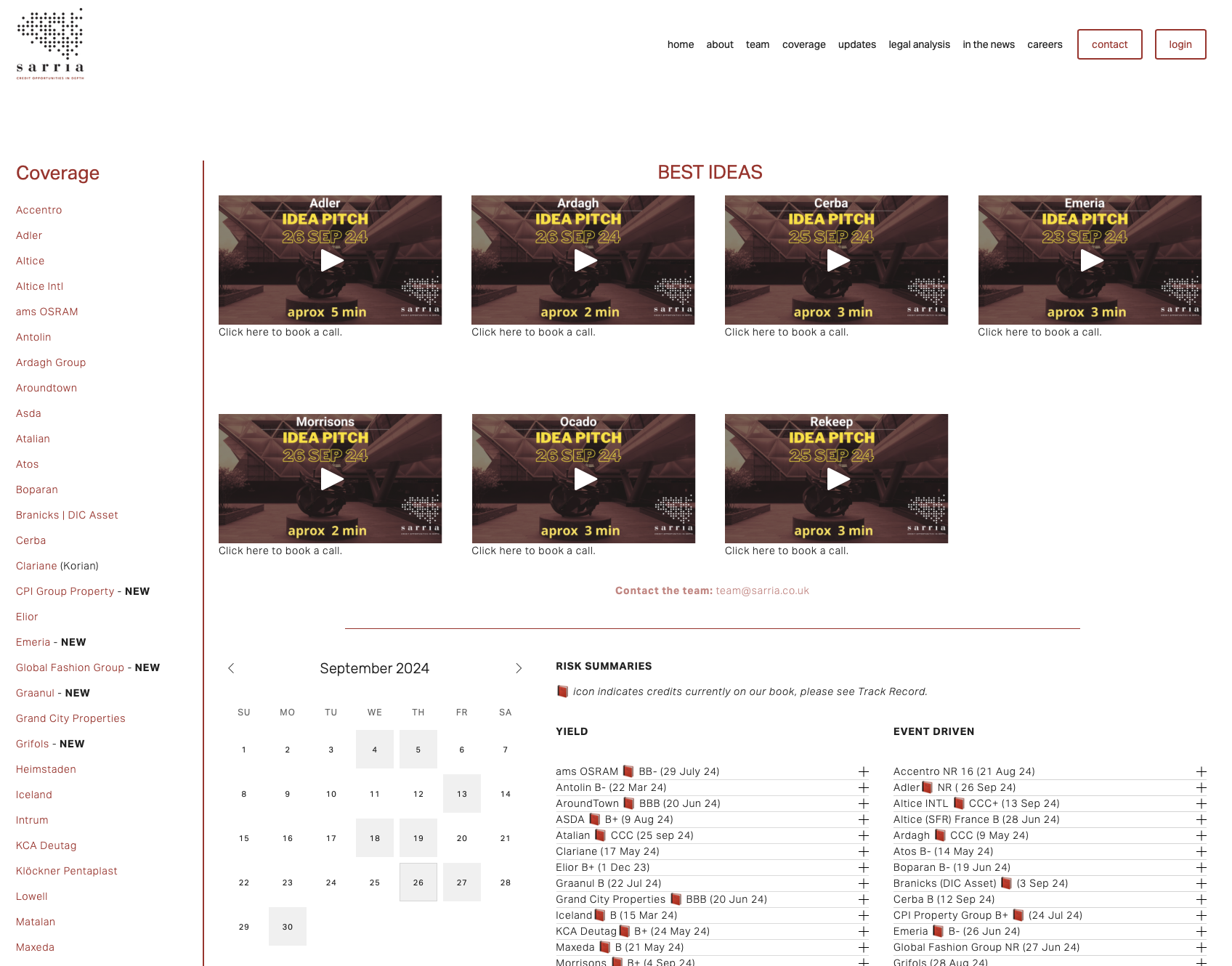

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

Please find our significantly updated analysis here.

Adler finally concluded this second restructuring and the company now has five years to head for the third. The requirement to keep the ADJ bonds

No questions this morning on the Adler call as the meaty issues are not suitable for public discussion on a call. Notably, the yielding portfolio received a

TopCo bondholders voted each bond issue vastly in favour of the restructuring, paving the way for a relatively inexpensive and straightforward implementation

Please find our updated analysis of Adler here.

It’s gone wrong. The proposed restructuring does not decrease, but increase the PIK burden on the company, putting it under more, not less pressure to sell its volatile development land bank as

We are disappointed this morning that the 2LNs are unable to take out the vast 1L and 1.5L financing ahead of them. The transaction also leaves €2.3bn

Please find our updated model on Adler here.

ADJ bonds are down today on an S&P downgrade that comes a year late in our opinion. Still, we didn’t have it on our screens and bought 5 points higher on the 29s. We know some

Please find our not-yet-updated analysis here.

For all their fur, Adler bonds are rightly trading at a discount to the rest of the market. But that could change more quickly than we thought. Bondholders are

Following last year’s restructuring and the squeeze-out at ARE, as well as the eventual contracting of an auditor, the SteerCo - prompted by

German cities are rarely good buyers of real estate, usually cash-strapped and reluctant. So we are all the more surprised that Adler

There was an odd request to the Derivatives C'ittee earlier this week about whether ARE’s “sex change” from AG to GmbH constituted that it’s now a

We are wondering this morning about the health reasons that Chairman Stefan Kirsten cited as reason for his departure from the board. The timing is curiously

Please find our unchanged model of Adler here.

We had expected yesterday’s verdict to provide more clarity to Adler and therefore to generally boost valuations of a name that has lagged behind the

The UK’s court of appeal has overturned the approval of last year’s restructuring. That’s a shocker. There is certainly no easy solution the

Please find our updated analysis of Adler here.

As a name with considerable fur, Adler has been lagging in the recent rally. Most importantly and possibly imminently, the court of appeals could

According to Adler, Bafin have concluded their investigation into the company’s 2019 financial statements without imposing a fine or ordering any

Q3 and the call this morning were somewhat uneventful. The company has appointed a total of three auditors to deliver a patchwork of audits across the group. During Q3, the

Vonovia’s Q3 results this morning highlights that there remains at least minimal liquidity in the residential market in Germany, with €1.7bn of sales in Q3. Reassuring

The squeeze out is going ahead. Adler is spending €30m = €8.76 per ARE share for the 3.4m shares in float. We think this should also

The company is finally initiating the appointment of an auditor for its holdco Adler Group SA. AVEGA Revision S.à.r.l. has sent a declaration of acceptance. Adler will be audited by a

We said before: if you can pay 97c, you can pay par. We suspect that of the €69.5m tendered amount, €63 came from ARE’s own holdings, representing a

Adler anticipate bringing the new bond on October 9th. Meanwhile, the company discloses that it’s in advanced talks with a group of auditors to audit several

The 21% PIKs are placed and will go to pay down the convertible and the Schuldscheine. The new bond has only a 2025 maturity - in line with