- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro, Capital and Legal Structure - 20 Mar 24

Investment Discussion - 20 Mar 24

Industry, Economics - 20 Mar 24

Business & Transformation - 20 Mar 24

Refi Dynamics - 20 Mar 24

A little More revenue, significantly lower EBITDA and more CapEx are not boding well for the Autosupplier as we go into the first round of tariff discussions on Auto imports to

In what could be a cautionary note for other auto suppliers, Schaeffler issued a profit warning this morning reducing its EBIT margin from a market consensus of

Please find our all-new analysis of Antolin here.

We have been reviewing our automotive names side-by-side, so as to create a bit of an industry view and ensure we view each bottom-up name in a

In line with the downturn in the auto parts industry, the Spanish auto parts group reported Q3 results that were reflective of the industry. Revenues declined by

Please find our updated model here

Antolin reported at best mixed Q2 2024 results yesterday. The company was held back by weaker-than-forecast vehicle sales (especially production delays in

Antolin’s Q2 2024 were held back by weaker-than-forecast vehicle sales, but cost control meant EBITDA (and margins) beat our expectations. We will be

Antolin today priced their €250 million senior secured notes due 2030 at 10.375%. Use of proceeds is to refinance the existing

Post an agreement with the lenders on an A&E, non-core asset sales and favourable market conditions, the Spanish auto-parts supplier launched a

The company is speeding towards a refinancing of its 2026 notes after reaching an agreement with its lenders on €530 million debt facilities

The company reported Q1 2024 results which confirmed our negative view. Revenues declined by 10% to €1.04 billion and below our estimate of €1.2 billion as revenues from

Post the earnings call yesterday, the company’s guidance on the call was mixed with flat topline growth (due to model volatility) and slower order intake of €5.5 billion at 6% margins but better than expected EBITDA margins of 9% and €400 million for

The company announced Q4 and FY 2023 results this morning. While the results were pre-announced a couple of weeks ago and were in line with

Please find our new analysis on Antolin, here.

While we think in the current recovery mode for car sales - Antolin will show signs of growth in the medium term. However, given its current leverage and ambitious goals for growth as

We are rotating out of a number of names that have either fulfilled their investment thesis or have failed to do so or have otherwise traded up significantly post March and therefore hold more beta than alpha now:

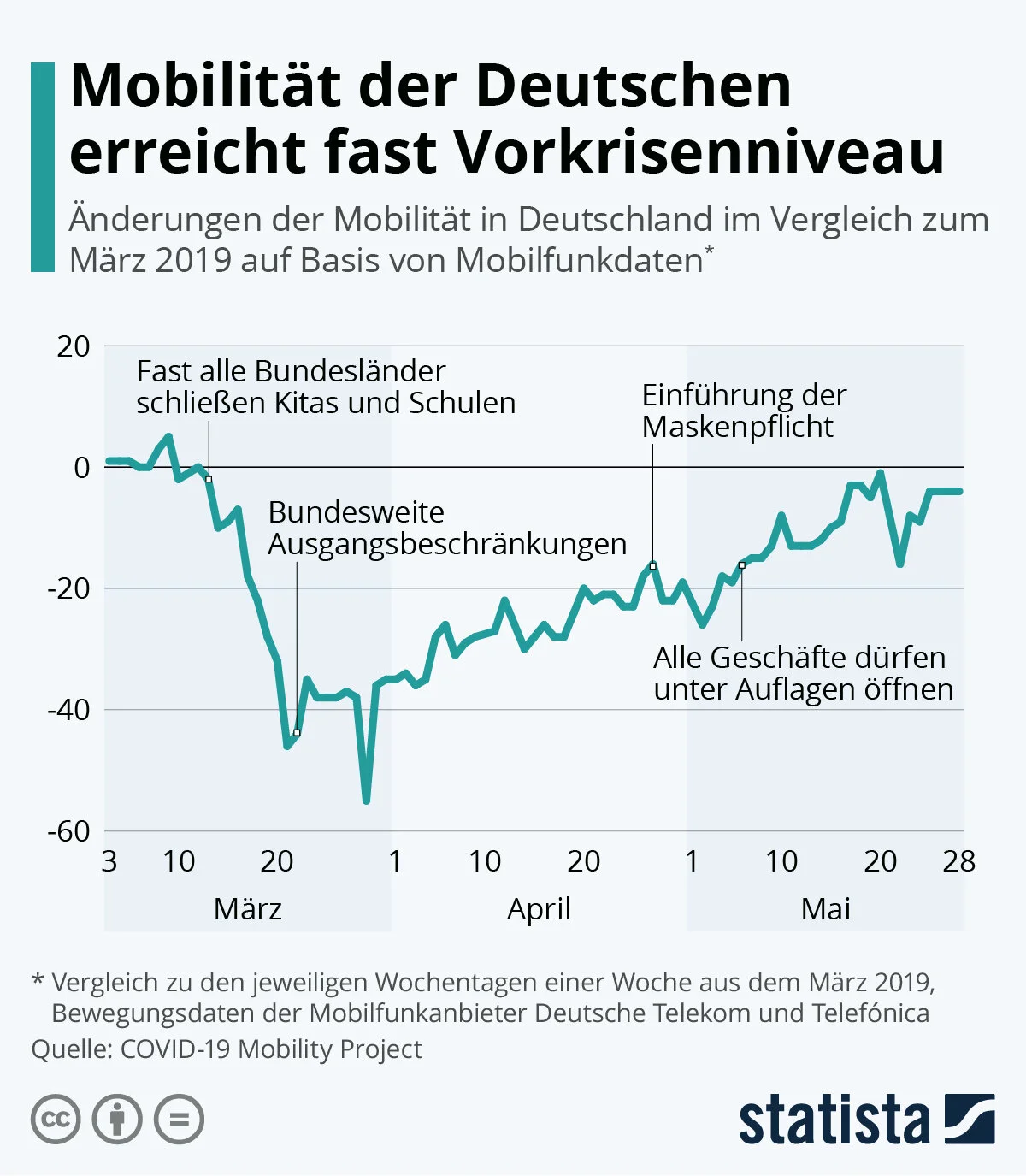

We are definitively working on more short ideas, but here goes a different view. Below is my entry for graph of the month.

The market has traded up

Some mixed signals from Antolin on the call.

Liquidity:

- On the one hand the liquidity situation looked better than anticipated as despite the Sales trough falling into April, much of the WC related cash outflow falls

Please refer to our analysis of Adient here (Antolin to come) and to previous comments on volume expectations, China volumes and rebound to date by OEM segments.

Two random themes from Germany this morning: Car Industry Investments and Consumer Rates.

1) Car Industry Investments:

The German car industry could be shedding some 10% of

Below are some random graphs that caught our eyes this week:

1) To our dear American Friends for Thanks Giving: Thank you very much from Germany!

FYI: Some visual orientation.

Clearly this has implications beyond merely Germany and the automotive sector.

We have recently been eyeing Antolin for a short. S&P have the company at B+ with stable outlook and Moody’s at B1 with negative outlook. Both have downgraded the company at the turn of the year.