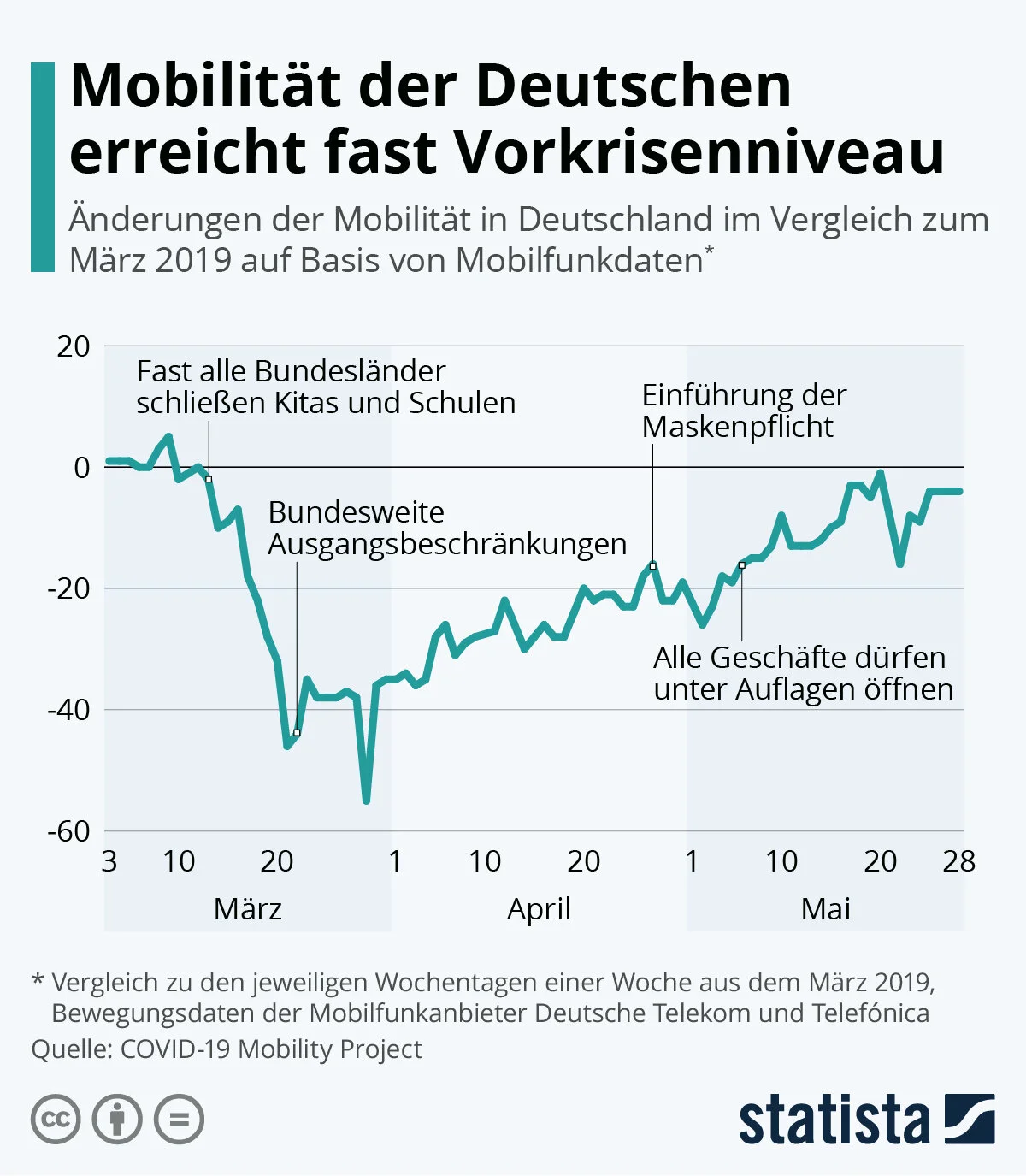

We are definitively working on more short ideas, but here goes a different view. Below is my entry for graph of the month.

The market has traded up

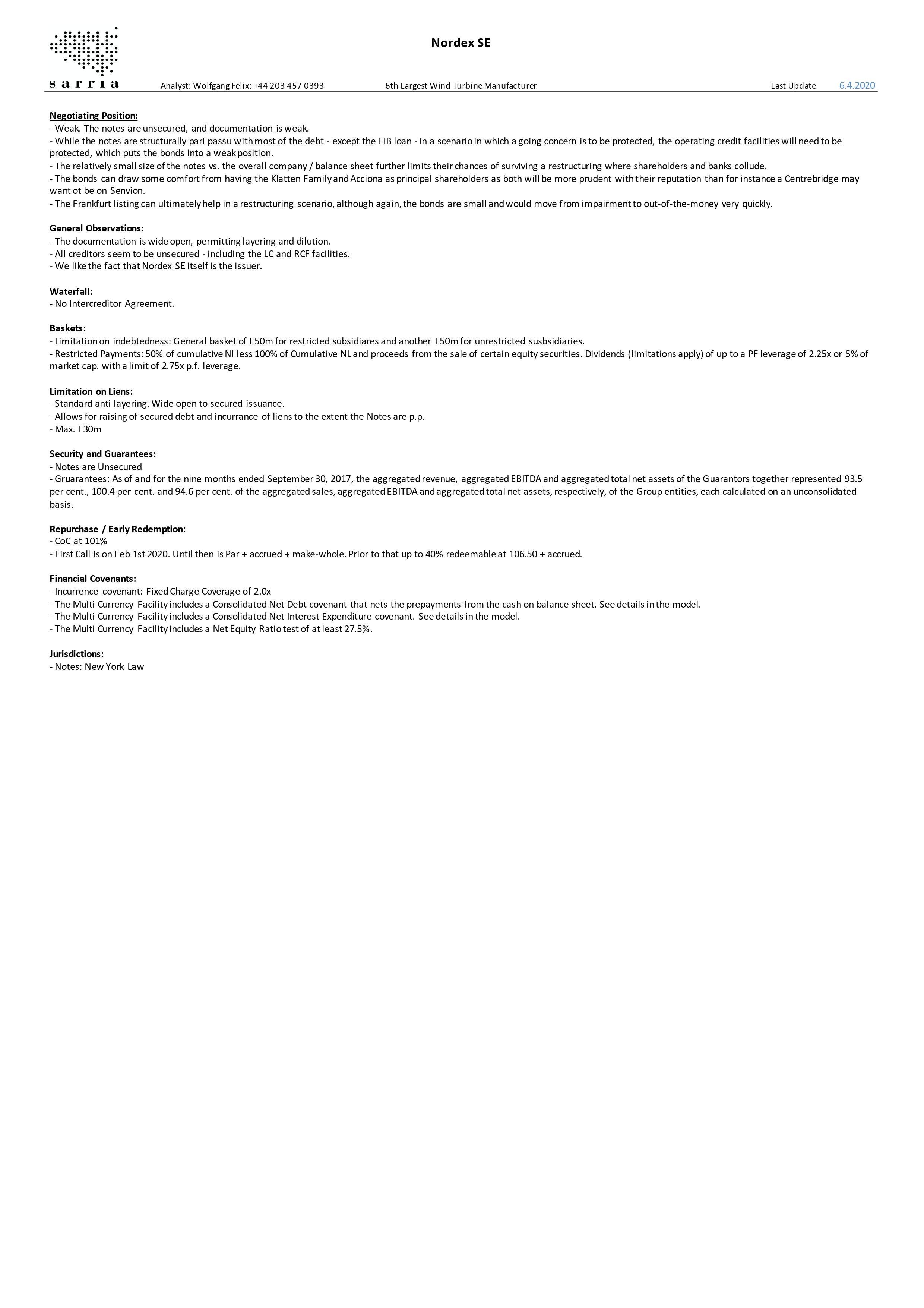

Please find our update on Nordex here.

The company’s new family of D-4000 turbines has proven to be immensely successful, allowing the company entry into the US and other markets and promising improved margins for this year and next. Order books are overflowing.

However,

We had modelled the cash squeeze at Nordex in all its detail late last year, but the company exceeded our expectations, or the Delta 4000 did. AS such, Nordex can probably make

Sales are slightly weaker and gross margin slightly stronger than we expected from the order/volume ratio previously communicated. But in the scheme of things

please find our updated analysis on Nordex here.

The company has still not answered our questions regarding sustainability of the elevated prepayment levels and covenant

All,

Please find a light update to the model and analysis here.

We repeat that we would not be exposed to Senvion at

Regarding Senvion Consent Solicitation:

Again, as per the first consent solicitation, this is a formality as the majority of the bonds is already controlled

Senvion GmbH have filed for Insolcency in Germany - specifically for a procedure that allows for a self administration (DIP) process, where management stay in control.

Senvion announce that the consent solicited last week has been obtained

As per pour mail last week, Senvion have still not found a financing solution and cash is running extremely tight.

Senvion are out with a consent solicitation. The request is to raise the threshold for acceleration of the bonds from 25% to 50%.

Having dodged the Q4 bonanza, we are putting the short on again with 4% of NAV for now. We are looking to capture 30+ points of downside. Please find the updated analysis

Correction: the Polish business made Zero Ebitda in 2018. This means the value to bondholders is primarily in the cash consideration the company receives from

Nordex reported much as expected yesterday. Most importantly, management pledged a frugal approach to pre-producing turbines, which could quickly put their balance sheet

Nordex are to report their 2018 statements (recall that we have taken the short off). We expect a sudden movement into a net cash position on the back of significant prepayments on orders won in

An internal memo by Senvion CEO Yves Rannou has been leaked.

It gives no specifics unfortunately, but it does support our thesis that:

1) The turbine portfolio is narrow, but - for lack of sharing

Following lender's rejection of Triton’s initial offer some two weeks ago, Triton have agreed to inject E50m in cash through additional equity.

We have given our Nordex analysis a detailed update. Following the company’s recent guidance for the full year, there is little point in keeping our short open

As we are expanding to coverage of 20 names in the coming weeks, please find attached a slightly higher level analysis