- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Capital and Legal Structure 15/07/22

CashFlows and Valuation 15/07/22

Retail 15/07/22

Investment Discussion 15/07/22

Ocado Logistics and Technology 15/07/22

We still maintain that the row between Ocado and M&S is a negotiating point regarding the price that M&S will eventually pay to buy

We are puzzled by the fall in share price after the results and call. We do think that management may fill any funding gap with debt rather than equity, but that will eventually be a

A Q4 revenue increase of 17.5% is quite an achievement. Naturally, the caveat here being that this is not what’s directly driving the

The issue looks to be inventory-driven rather than an IT failure, which will relieve Ocado management. Christmas is as busy as it gets for online grocery, and

Morrisons pivoting towards online order fulfilment via store picking is a negative for Ocado but partly reflects Morrison’s need to utilise its largely

A new Chair is not the top priority for Ocado, but a former tech executive who also has experience chairing a PE-owned business would be

Whilst Ocado will find Tesco a formidable competitor, it is a lot further down the road in signing customers and delivering a product. Ocado opened its

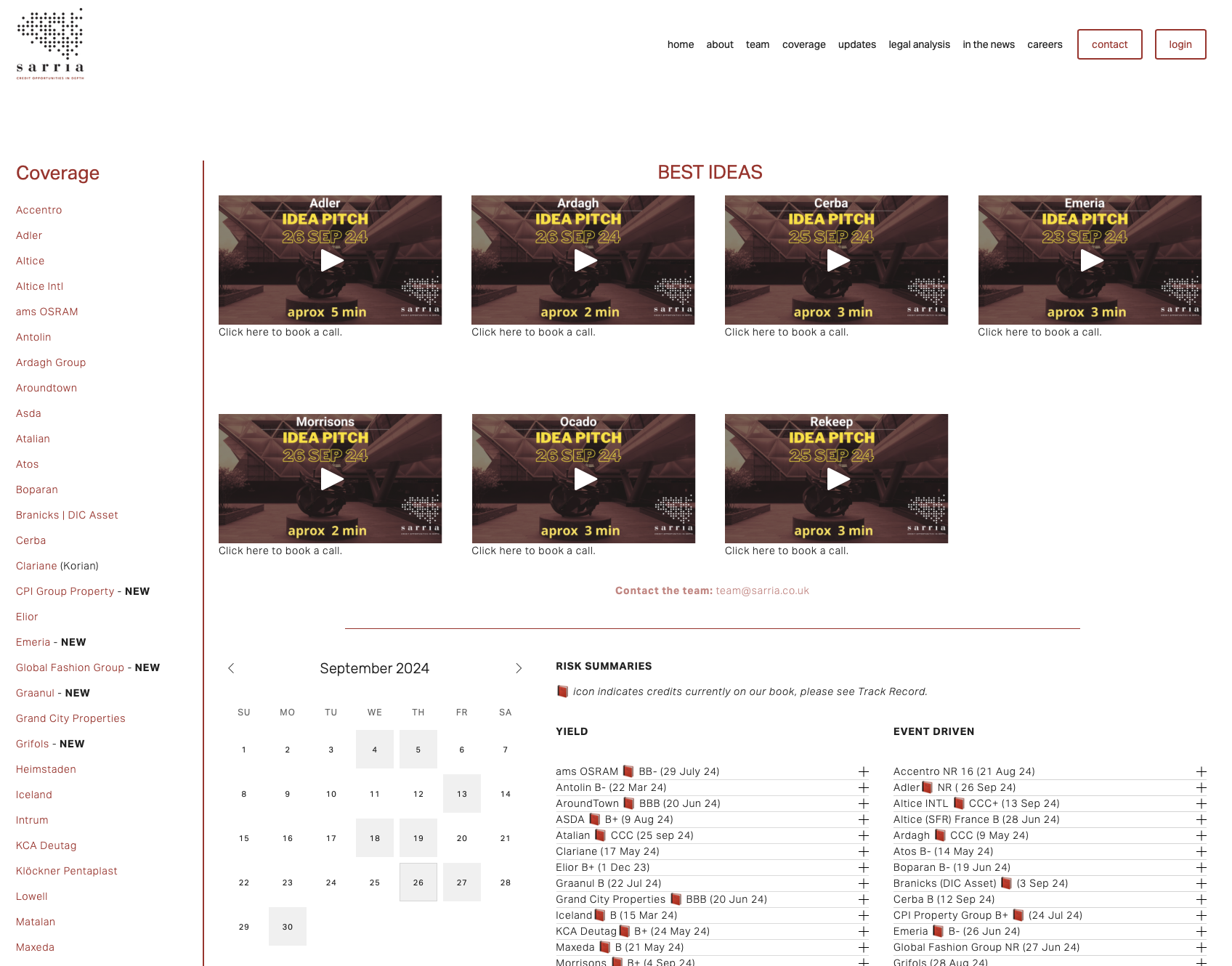

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

Strong results and increased guidance from Ocado Retail are a mild boost for Ocado Group, and the relationship with M&S has

Please find our analysis updated for the latest results here.

The recent Convertible and SUN issuance has dealt with the refinance risk for Ocado in 2025. Our forecasts currently have Ocado fully funded to

Ocado’s tender for the 2026 SUNs at 93p/£ looks more attractive than 93p/£ for the 0.875% converts. This makes sense as Ocado will want to

It’s encouraging that Ocado secured the SUNs at the tight end of guidance (10.5%, priced at par) and upsized from £350m to £450m. As we mentioned

The new debt/convertible will cost around £38m more in interest, but it fills the maturity gap for the company and is positive for creditors. We are

Ocado’s successful placing of £600m in debt removes the immediate maturities and is a positive for creditors. The cost of debt

We do not see much incentive for the 2025 holders to tender much beneath par as Ocado is likely to call any stub rather than allow it to become