The last 15 months have seen an incredible rotation of risk and returns and many of the names that offered opportunities last year have done phenomenally well, either because the feared drop in revenues never occurred, or because

We maintain our long position in RAC B notes. This Dutch tender is positive for the credit and further demonstrates the likely early call of the balance of B notes in July 2021 at

Please find our updated model here.

We had expected a decision on a potential £70m dividend to shareholders, but Company has not made a decision as they contemplate a refinancing of

Please refer to our unchanged analysis here.

Following on from RAC numbers earlier this week, plus the plethora of Rule 8.3 disclosures, we have again gone over the shareholder register for the AA Plc. We shouldn’t over-estimate

Please refer to our unchanged analysis here.

H1 results confirm our investment thesis, but crucially: churn is not up, not flat, but its down (15.8% versus 16.6% in the corresponding 6 months prior). Revenues are marginally

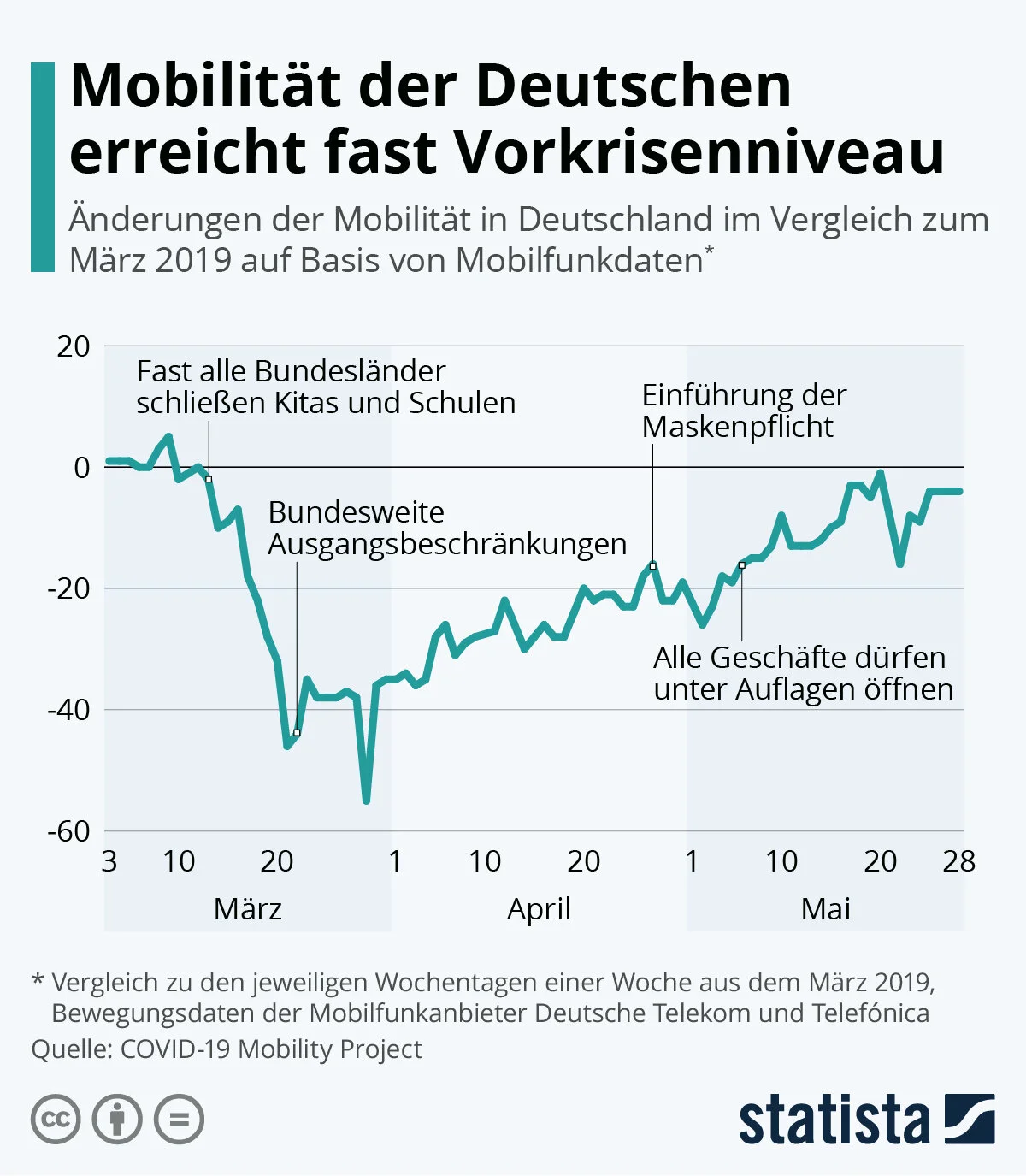

We are definitively working on more short ideas, but here goes a different view. Below is my entry for graph of the month.

The market has traded up

Below is an account of each of the names we follow and have begun work on in the context of Covid19 and Oil prices. Several names stand out as having become either uninvestible or outright attractive - already now.

RAC results had been already released end of February, so there were no fundamental new news from the conference call.

Positive:

Management were very

RAC FY19 numbers exceed model:

- Sales: H2 £318m versus £307m

- Gross Profit: H2 £162m v £154m

We have completed our analysis on RAC here, prior to the release of their results on Wednesday 26th February (with their conference call a fortnight later on 11th March).

We are taking a