- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Intro Cap & Legal Struct-30Mar23

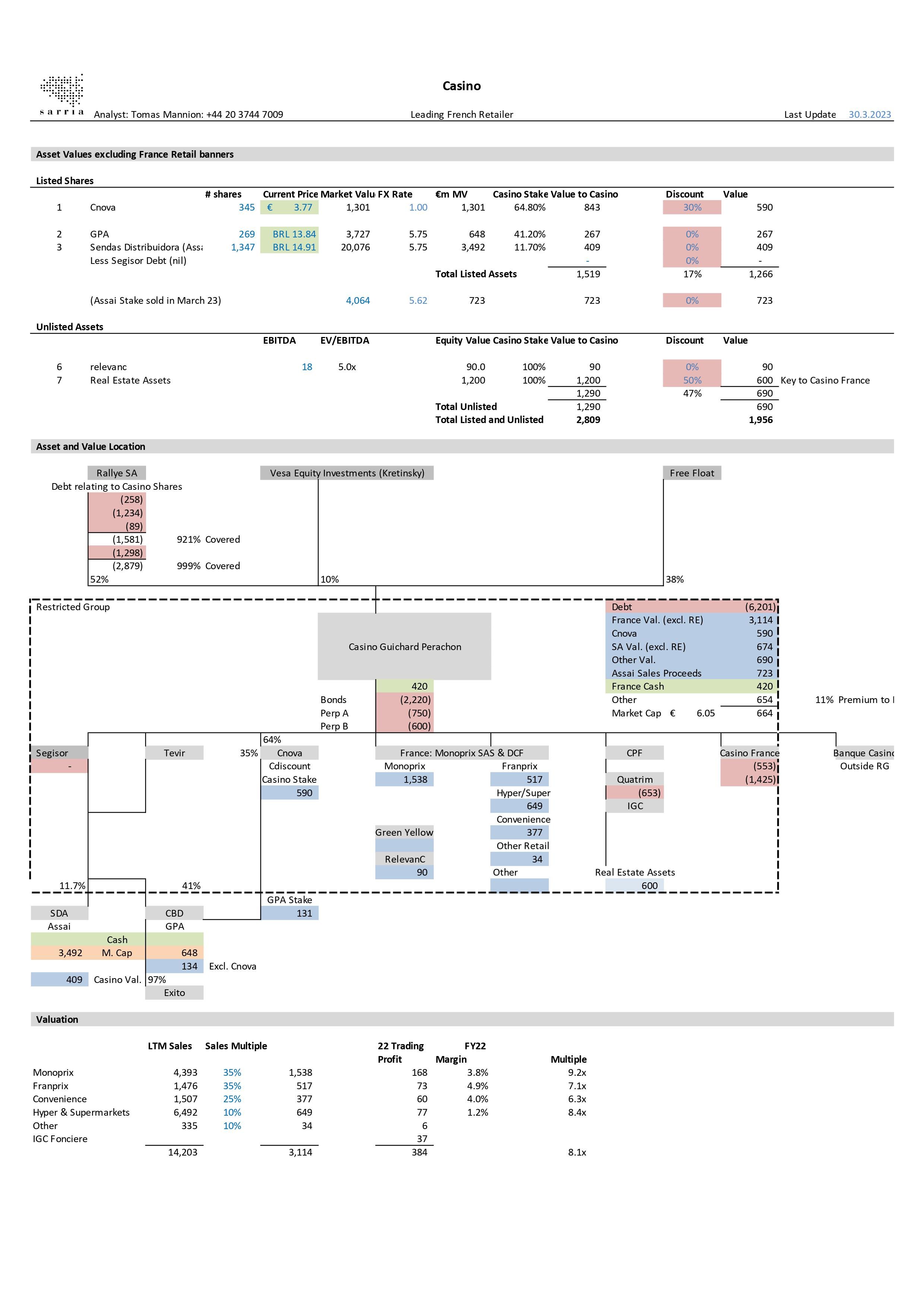

Teract Merger | GCP - 30 Mar 23

Latam Assets - 30 Mar 23

Invest. Discussion - 30 Mar 23

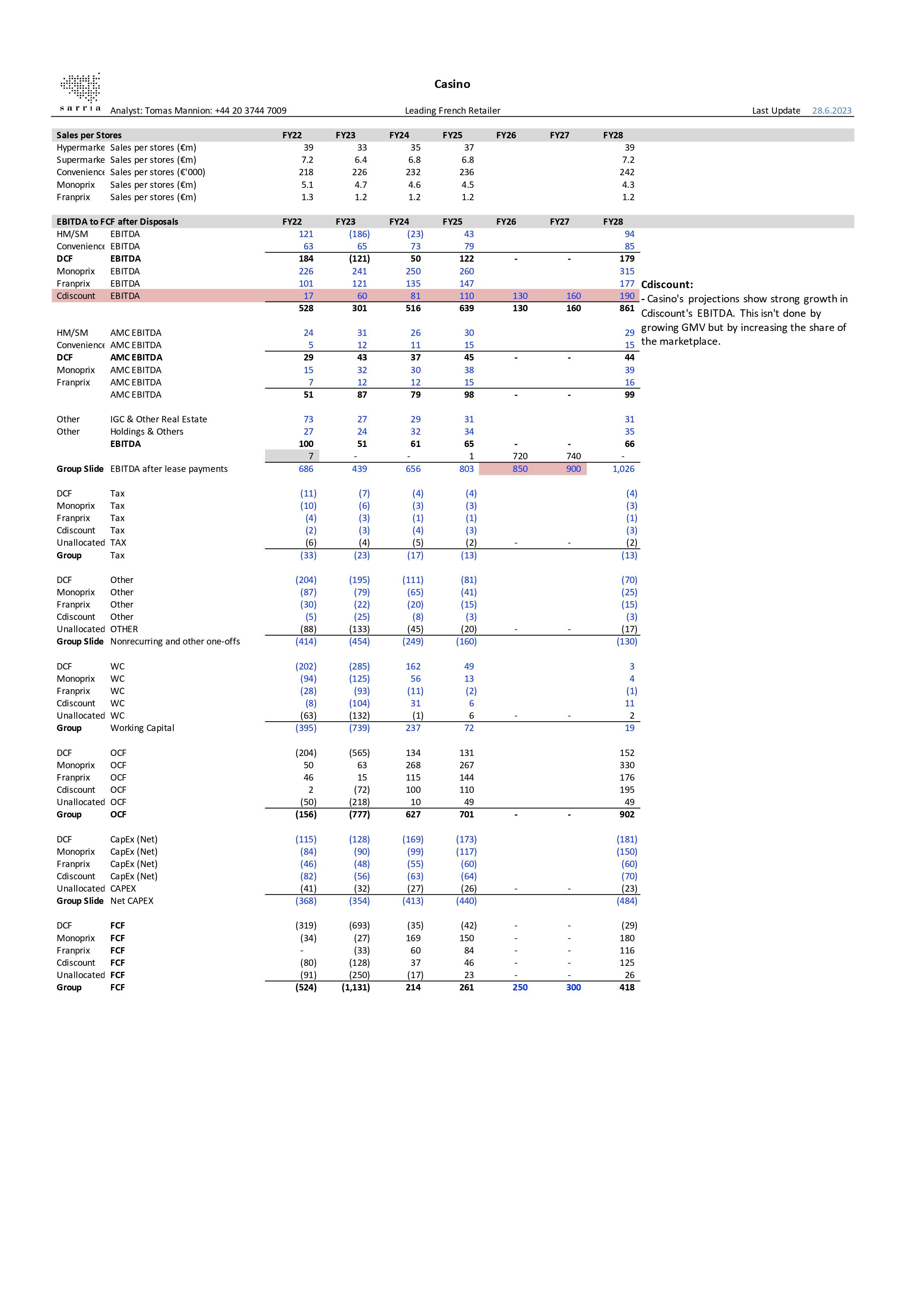

France Retail - 30 Mar 2023

All too late. Casino finally get around to exiting another segment of their South American holdings, with Casino, and indirectly GPA, selling their stake in

Casino have come to an agreement in principle with Quantrim holders, concerning the extension of the facility by three years to January 2027, with an additional

Months after Casino failed to pay its coupon in July, it appears that the CDS has been triggered, and in time for the September contract

Casino have extended its agreement with GPA in order to coordinate their voting/control when Exito is listed in the coming months. The process of

Please find our existing analyses here: Adler, Aggregate, Casino and Naviera Armas.

It’s time we bring out our dead. To fund new positions, such as Selecta yesterday (see here), we have been clearing out a few positions to make way for new ones, such as

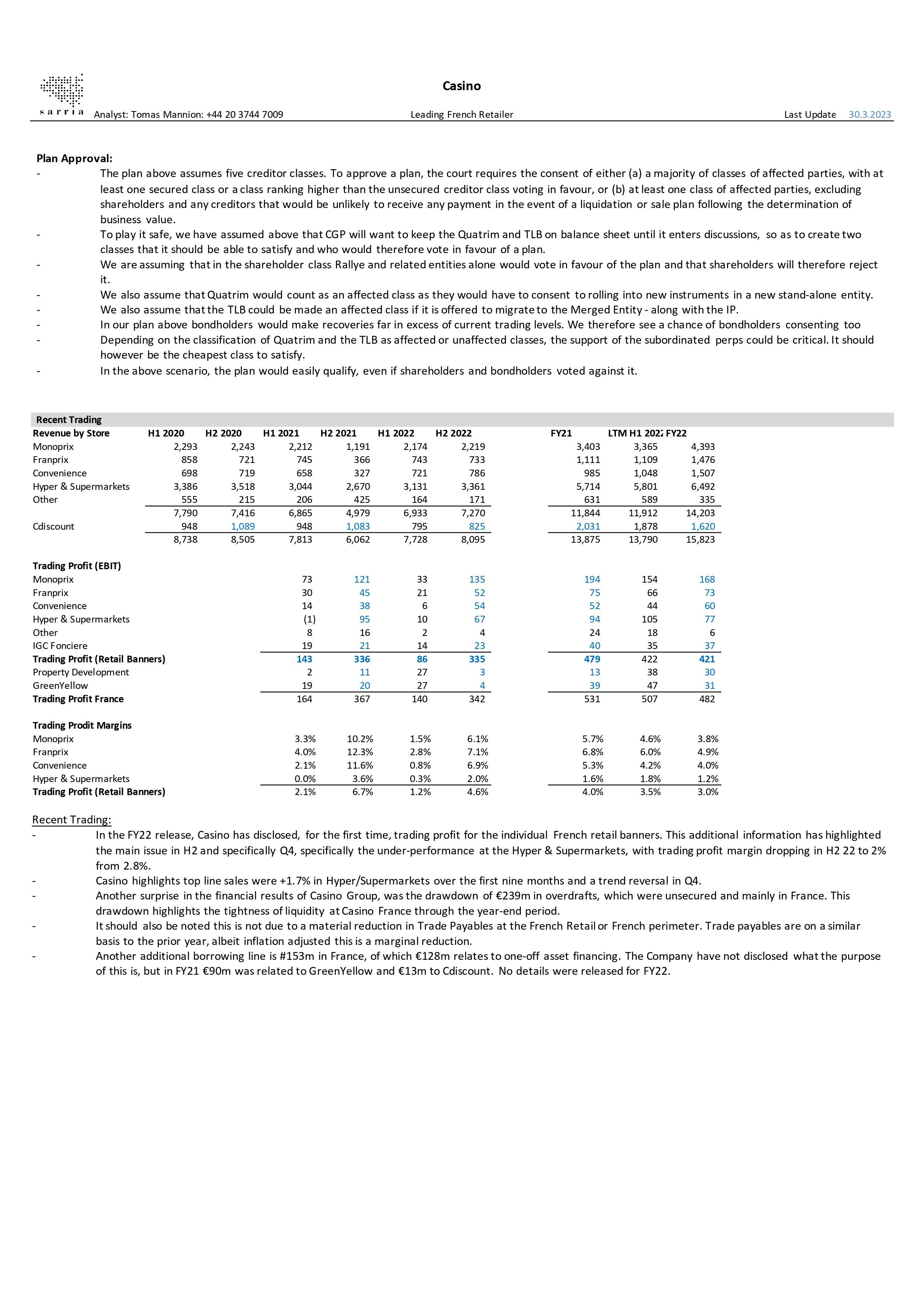

Casino has entered the next stage in its restructuring, reaching an agreement in principle with EPGC (Krentinsky), Fimalac, Attestor and some of its

Casino held a brief conference call this morning with the full release of their Q2 numbers. There has already been plenty written on the back of the

GPA have declined the bid from Jaime Gilinsky for 50% of Exito and intend to pursue their plan list Exito. Separately, Casino have scheduled their

The Consortium of EP Global Commerce, Fimalac and Attestor will likely gain control of Casino, but this hasn’t stopped other suitors from trying to peel off assets. Lidl, the German discounter, has

There is a winner, and it is not the unsecured creditors! Casino confirmed yesterday's news that 3F has pulled out of the race, leaving the EP Global Commerce

The FT is reporting that Daniel Křetínský’s will be the likely successor at Casino with the 3F consortium abandoning its bid. The lack of any bidding tension coupled with quotes from Křetínský asking creditors to be realistic and that

Tomas is on holiday. His reaction yesterday night only read: “What a sh*t set of numbers“. Anyhow, if we were management right now, we’d drop prices

Two very different proposals: One is a big, confident splash, the other a cleverly structured crowd pleaser (crowd not including bondholders…). One suggests

Bondholders of course did not have time nor perhaps the inclination to put in a bid for the company last week and so the only two bids for the company are by

Waiver requests, denials and the question why bother! Casino have sought waivers for the duration of the conciliation proceedings (until 25th October, at the latest).

Agreement to the waivers was received from holders of the Quatrim.

Agreement to the