Casino - Breach Or Not - Positioning

All,

Please find our updated model on Casino here.

Despite sequentially improving sales figures, the Company requires access to liquidity and accordingly is coming at least close to facing a covenant impasse in the coming quarters, especially for Q3. The credit story of Casino remains the same - an underwhelming core business with the hope of non-core asset sales which will aid the Company to delever. Because the GreenYellow sale will come too late for Q3 covenant calculations, we explore other avenues available to the Company to deal with its upcoming covenants. The concern surrounding the covenants has created a trading opportunity, highlighted below, and we are positioning ourselves accordingly.

Covenant Headroom:

- With Casino, every quarter is a focus on the upcoming covenants and the potential for them to be breached. The upcoming Q3 quarter is no different.

- In the past, analysts have been fearful of the interest coverage covenant but with the capitalised interest costs from Q1 2021 now no longer part of the LTM interest bill, the focus switches to the Secured Gross Debt Covenant.

- The Senior Secured Gross Debt Covenant includes just senior secured debt at Casino France plus any secured debt at Segisor (the majority of the Segisor debt is unsecured). EBITDA is defined as EBITDA France, excluding GreenYellow, less lease payments.

- A breach of the Senior Secured Debt covenant constitutes a default under the Senior Facilities and therefore would require a waiver from the secured banks.

- But the main point of the covenant is that it is only senior (secured) debt. This excludes the two Monoprix facilities, namely the €40m and €130m facilities maturing in Jan ’24 and Jan ’26 respectively. Given their structurally seniority, the majority of the market treats them as senior secured), but for covenant purposes they are excluded. There is the potential to raise other unsecured, structurally senior debt at other banner entities, but the Company reassured that they were not exploring this option.

- Headroom at June 2022 was €227m of additional senior debt implying €2,342m of senior debt. We can identify €2,320m of his, and after speaking to the Company there is small single digit portion of the Segisor debt which makes up the majority of the difference.

- Casino historically funds its Working Capital outflow in Q3 via its RCF (secured) and Commercial Paper issuance. The covenant limits the availability of the RCF, and with limited access to the Commercial Paper market, first glance it would appear Casino can’t meet its liquidity requirement within the constraints on the covenant.

Working Capital Movement:

- In line with other retailers, Casino has significant seasonality in its business. Normally, Casino has a significant outflow of Working Capital in Q1, inflow in Q2, outflow in Q3 and large inflow in Q4. However, Casino only disclose the working capital movements semi-annually and given the other moving parts in the cash and debt figures it is not possible to estimate the movement at Q1 and Q3 periods.

- In discussions with Company management, we have estimated the working capital movement (outflow) to be c. €400-450m in Q3. This is lower than implied historic levels of €550-600m but we have rationalised a lower working capital swing in Q3 due to slightly higher overstocking at the end of Q2, the removal of Leader Price and more focus on Convenience model which will have a lower working capital cycle.

The Maths:

- In Q3 2021, Casino experienced an outflow of €615m from EBITDA of €158m. This implies Working Capital, Interest, CAPEX and other outflows totalled €773m in Q3 2021. Assuming a lower Working Capital swing of €425m this leaves c.€600m net cash outflow for Q3 2022.

- Closing Cash at end of June was €405m in France. So, Casino needs to draw on its Senior Secured RCF to fund themselves.

- The requirement is €200m plus minimum cash required of c. €200m, therefore €400m minimum requirement.

Mechanism to meet the covenant:

Lever 1:

- The obvious answer is an improvement in EBITDA, which will increase senior leverage capacity. Given the sales momentum since covid restrictions were lifted, and the disclosed 4-week Kantar data for July, Casino France Retail should experience strong Q3 results versus Q3 2021. This in turn will lift EBITDA (less GreenYellow) for covenant purposes from its current LTM EBITDA of €734m.

- Performance in Q3 2021 was poor with France Retail and E-Commerce generated €152m of EBITDA (including leases) in Q3 2021, down from €199m the previous year. We are projecting sales to be in line with Q3 2020 levels, projecting EBITDA to be on a par with 2020 levels.

- Assuming it achieves €199m of EBITDA, LTM EBITDA would increase to €781m. This would allow an additional senior secured debt of c.€370m, adjusting for the buybacks in early July.

Lever 2:

- Although Casino have entered into a TRS for the remaining Mercialys shares, no cash has been received nor does it impact debt levels as at June 2022. As a reminder, on April 4th this year, Casino entered into a TRS to dispose of 10.3% of Mercialys equity. Proceeds were expected to be €86m. The TRS is with CACIB (Credit Agricole). At current levels, €8.33 a share, the stake is worth c.€80m. As of July 20th, CACIB have reduced the stake to 9.2%. The sale of these shares, if possible, would generate €75-80m of cash. Given the liquidity of the Mercialys shares, we don’t envisage the TRS to have closed by quarter end.

Lever 3:

- Sale of other non-core assets. Casino holds €778m of Assets held for Sale (IFRS 5 disclosure). Included in this would be €600m for GreenYellow, €75-80m for Mercialys, leaving a balance of c.€200m. We pushed management on the possibility of a sale in the coming months, and although they wouldn’t confirm any details, they suggest that given the small size of the remaining assets they could sold at short notice. Nevertheless, although there is perhaps the potential for €200m of asset sales, we assume that only the disclosed disposals of €27m to be closed by Q3.

Lever 4:

- Casino have the option to change the timing of some CAPEX, and/or seek additional unsecured debt to bridge the GreenYellow proceeds.

-> In aggregate, Casino could secure an additional c.€370m of Secured Debt from improvement in EBITDA levels plus €30m from asset sales, which is equal to the minimum requirement.

What can they do at Cnova?

- Currently, Cnova has net financial debt of €470m, Gross Debt of €512m. €307m is borrowed from Casino, via the Current Account Agreement, €120m via State Loan, €66m in an overdraft, €11m in an SPV borrowing for inventory financing and €9m other.

- Cnova has €70m overdraft (unsecured) with €66m was used at the end of June.

- Cnova extended their €120m State Guarantee Loan to 5yrs in June 2021. As part of this extension, €60m will be repaid in August 2022, with the remainder paid in the following stages

- €30m in Aug ’23, €18m in Aug 24, and €6m in Aug 25 & Aug 26. - Cnova has the ability to raise €70m via a bilateral credit line. This facility appears to be unsecured but is likely to be used to replace the state Guarantee Loan, so no additional debt at Cnova level.

Would the banks enforce?

- Firstly, a breach of covenants only impacts the RCF availability and it would require 2/3rd majority of the RCF holders to enforce acceleration. Although some of the RCF has traded into non-French bank hands, we still believe that the majority of the facility is held by original holders. And more importantly, it is held by secured creditors of Rallye which will influence any decision to enforce.

- A Sauvegarde proceeding would allow Casino to term out its bonds, specifically the unsecured, which would postpone cash outflow of €1.1bn before the maturity of the Senior Credit Facilities. We are unsure how Sauvegarde Acceleree would treat the Secured “Quantrim” bonds and if those could be extended or treated in line with the secured debt. However, Sauvegarde would almost certainly require Casino and therefore its senior banks to organise funding for Working Capital as Casino is an operating entity. The risks associated with putting Casino into Sauvegarde Acceleree infinitely higher than at a holding Company like Rallye.

- We question the sanity of any decision to enforce given that banks would likely have to fund Casino’s working Capital through the procedure having to step in for €4bn of payables alone and would put at risk Casino as a going concern. Also, an additional €600m of liquidity will be added to the Group post closure of the Green Yellow business. Enforcing now has the potential to destroy value for banks across all their exposure and removes any leverage they may have over Casino. At a minimum, we would expect a waiver to be granted, potentially as a quid pro quo for the majority of the €600m proceeds to be used for Senior debt reduction.

-> As a result, we don’t think banks will enforce.

Options available to the Company:

- French insolvency regime provide Naouri with the opportunity to address secured creditors confidentially in a process called Conciliation. In that process, which typically would last 3 months, he would have ample opportunity to make the above points abundantly clear and present an alternative solution, probably involving asset sales.

- The standard CFO playbook would be to fully draw the RCF before starting any court proceedings which would increase the banks overall exposure. This approach however would destroy Naouri support system in Paris.

Arbitrage:

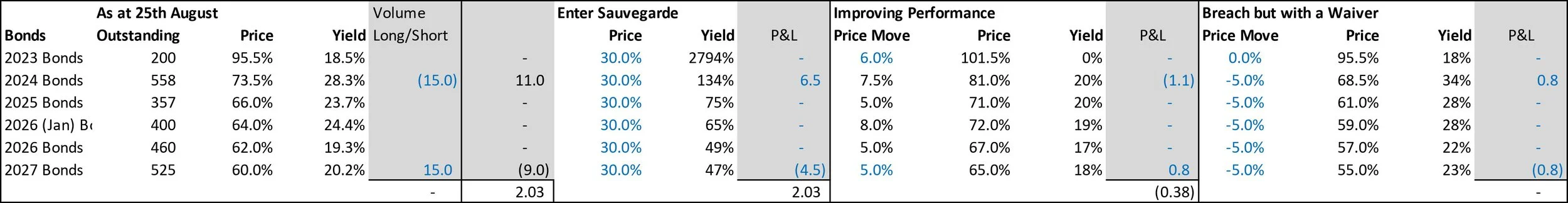

- There is the potential of a arb trade by shorting the front end of the Casino bonds and long the longer dated bonds. Because of the price differential, under a doomsday scenario where Casino enter Sauvegarde, the trade will profit as both bonds will trade flat to each other. In fact, under a blue blue sky scenario (unlikely) of a large LATAM asset sale, both bonds will trade flat to each other in this scenario.

- Under our base case scenario, where there is a slight improvement in performance, and the Company don’t breach covenants, we would expect the short end to rally more. However, the concerns would still remain and would expect the yield curve to remain inverted.

- If Casino breach their covenants, it is not certain the Company would enter Sauvegarde, and would in fact probably would receive a waiver from the banks. Under this scenario, both bonds would trade off further, but the shorter-dated bonds would suffer more.

Positioning:

- We maintain our 1% long position in Rallye Unsecured.

- We are also taking a long €15m face position in the 2027 at 60% in conjunction with a corresponding €15m face short position in the 2024 bonds, factoring in spread and borrow, to position ourselves for the tail-ends over the next three months. These trades combined net €2m of proceeds upfront, plus upside under curve flattening scenarios like a Sauveguarde-doomsday, or the “blue blue sky” scenario of a large LATAM asset sale - see table.

- The downside is our base case, of (a somewhat mathematical) €380k based on a slightly improving performance of the underlying French Retail business, which could steepen the curve if the 24s feel lucky. However, depending on the level of improvement, there is potential for the long-dated bonds to rally in line with the short-dated. (we have assumed that under certain conditions the short-dated bonds rally stronger than the long-dated bonds).

- The long-dated Casino bonds are trading as if Sauvegarde were a 50/50 scenario. With a YTM of above 20% we are not seeing the curve steepen much further from a mere yield perspective. Although we don’t rule it out, we believe that the Company has the ability to meet the upcoming covenants and with an improving underlying business, can give some headroom.

- We maintain our belief that the timeframe for Casino to deleverage has accelerated. In addition to the GreenYellow sale, we would envisage further asset sales during FY23 to further deleverage the Casino France structure.

- We still suspect the Company will attempt to extract value from its GPA stake, which is currently undervalued based on conservative EBITDA or sales multiples for its Brazilian and non-Brazilian (Exito) businesses plus the 35% stake in Cnova.

- Ultimately, we had expected Naouri to try to time any asset sales with another debt reduction effort at Rallye. Perhaps this is an acknowledgement that Naouri is no longer in full control of the timings and the covenant issues are now dictating the process.

Happy to discuss.

Tomás

E: tmannion@sarria.co.uk

T: +44 20 3744 7009

www.sarria.co.uk