Oriflame - Q4/Q1

All,

Please find our updated analysis of Oriflame here.

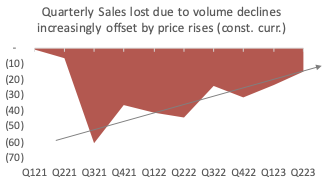

On the surface, little has changed since we last looked at the name ahead of its Q2 results. It remains as uninvestible as it was then. But aside from bonds trading down and then seemingly catching a bid in the 30s, at least one metric has continued to improve, such that for a while at least the company stands a chance of halting its slide by year-end, that’s one year after most its peers managed. It is not our favourite metric and alone it won’t last, but in constant currency terms, we see the continued slide of membership being offset by price/mix increases at around year-end. That should technically halt the top-line erosion once FX stabilises and do so with a notable effect on margins. But it’s the membership that really has to stabilise - and grow again, even if a 2026 refinancing looks well out of reach now.

Investment Considerations:

We are not as much waiting for a particular price on the bonds as we are waiting for any kind of signal that a bottom comes into view for the fast-dwindling membership. Bonds seem to have curiously caught a bid around 35 c/€, but we see Q3 in much the same light and so perceive little chance of outperformance over summer.

- One bright spot might be later this year when on a constant currency basis price/mix offsets membership decline on a global basis, but it’s really the latter that needs to stabilise to give the company a chance of survival. Never mind that restructuring is already a certainty.

- It is that stabilisation that we are looking for before we buy the bonds. Even if we have been cautious on the name and have steered clear of "getting involved" in the past, it is still on track to underperform our expectations and is lagging behind its peers considerably too. Until we understand why that is or feel assured that the business is not in terminal decline, we will remain on the sidelines, but we think this could become interesting around Q4/Q1 and because we think so already, maybe it does eventually become a mater of: buy first, ask questions later. Not yet.

A Glimmer of Hope:

- Membership continues to fall at 20% p.a. worldwide, in some regions faster. Also falling is units sold per member, but that has narrowed considerably and in LatAm for instance this has already been rising for some time. So we can attribute the bulk of volume losses to membership losses.

- What is increasingly visible is that price/mix improvements are offsetting the volume decline as far as we can attribute it to membership. In other words, fewer customers are buying bigger baskets so as to balance revenue on a constant currency basis if the trend continues for another two quarters.

- As the bulk of central bank action to combat inflation should be behind us, we expect also the bulk of EM currency movement against the Euro and the US dollar to come to an end and not to present another headwind next year the way it did this year. Once the global interest rate dust settles, there may even be a tailwind. But we are not FX traders.

- The trouble we have in getting excited about this new balancing is that unless the membership meltdown stops, the remaining members would each have to be millionaires bathing in Oriflame cream every day. Still, once price-increases manage to offset membership decline, we think the company can begin searching for a new equilibrium from where to rebuild its network. This could take all of 2024 we think, after which there would only be one year left to show growth.

- The hope then is not so much that creditors will be refinanced or that the shareholders put money in to amend and extend. We think that ship has sailed. But that there will be a nucleus company left that is worth owning in three years. That’s what we are looking for over the next six months.

Documentation and Creditor Position:

- The creditor position looks strong. So we could be tempted to buy the bonds when we see membership stabilise, provided they will still be cheap enough then to assume ownership of (not all of) the business in 2026.

- The documents pre-contemplate a distressed disposal that circumvents the loss of control creditors would face in Switzerland if no consensual deal can be found.

- We note that there is significant scope however for shareholders to raid the company ahead of events of assets outside the restricted group, including the significant Russian business. The documentation is however strong enough that a consensual deal should be better for the family and creditors than one where the company is split up. So we feel confident about the restructuring itself.

Looking forward to discussing the name with you.

Wolfgang

E: wfelix@sarria.co.uk

T: +44 203 744 7003

www.sarria.co.uk