Tullow - Oil prices isn't the issue - Production is!

All,

Please find our updated analysis on Tullow Oil here.

Tullow Oil | Live Discussion

Tomás Mannion - Head of Desk

Thur, 30th Jan, 3 pm UK time | 10 am EST

Tullow Oil is facing a pivotal 3 months with upcoming maturities and a near-impossible refinancing. Tullow was quick to announce to the markets the preliminary discussions between Kosmos and Tullow on a potential take-over, but these have fizzled out primarily due to the negative equity reaction to Kosmos’ share price. Tullow is now left to ponder the future on its own.

Investment Rationale:

- We are not taking an investment in Tullow at this point. We strongly feel the Tullow sub bonds will be repaid at par, but acknowledge the downside risk is enormous on the small possibility that Tullow embarks on a restructuring now. We see the risk as limited, as our base case is the Glencore facility is used to repay the sub-bonds, but any talks of restructuring will see these bonds fall 40-50pts.

- The senior bonds suffer from the same issue we highlighted at the time of the issuance. Although they have a springing maturity, they are ultimately exposed to the operational performance of Tullow’s assets. Operationally, Tullow has significantly improved its production levels, but the issue at Jubilee well J69 highlights the underlying risk. The decline in production figures in H2 at Jubilee means we are unwilling to invest at this moment.

- We expect a trading update from the Company by late January, with our focus on CAPEX and drilling plans for FY25 & FY26.

The issues:

- The sub-bonds fall due in March 2025, and base case assumption these will be repaid with the availability of the Glencore Facility with the shortfall, c.$120m resourced from cash on the balance sheet. However, the Glencore facility is relatively expensive ($ + 10%), and the cash balance will deplete to c. $300m. This does not address the RCF which was extended in November for half the size of ($250m) but only extended to June 2025.

- The overall capital structure requires refinancing, but this is nearly impossible due to two main issues. Despite winning the first arbitration late last year, Tullow still has outstanding potential tax liabilities in both Ghana and Bangladesh. Both are c.$400m ($800m in total) and although they appear vexatious, it is difficult to imagine a comprehensive refinancing while they remain outstanding.

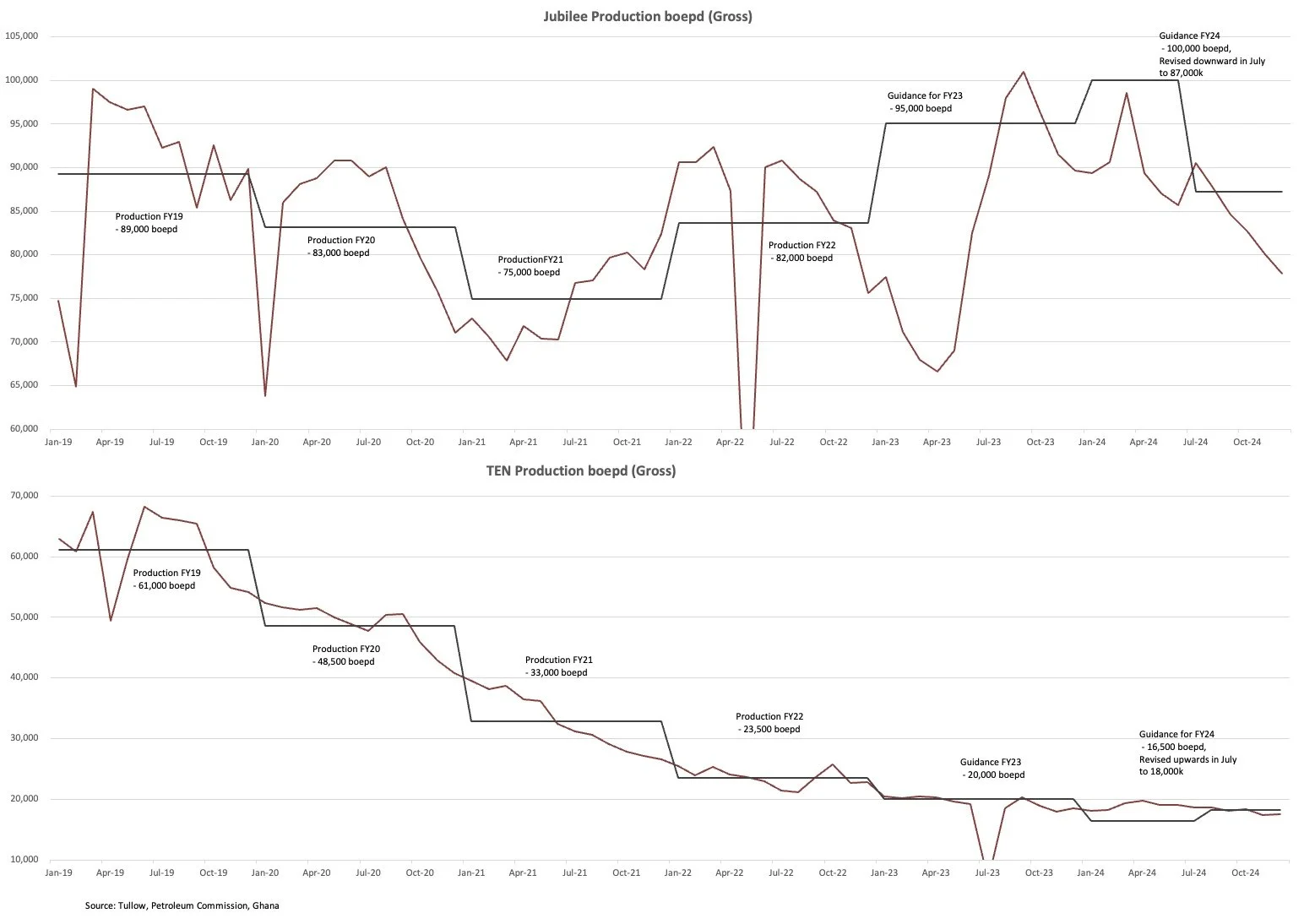

- The bigger issue is production levels. Jubilee field has performed poorly in FY24, with an issue surrounding the J69 producer well which was brought onstream in February 2024. There are issues concerning pressure communication from water injection in this specific area. This has resulted in Gross production guidance at Jubilee reducing from 100k boepd in January to c.90k, with actual production for FY24 reported at 87k. (This is not verified by the Company, but from production figures shared by Ghanaian Petroleum Authority. More worryingly, as shown in the graph below, monthly gross production figures at Jubliee have fallen from 90k in July to 78k in December.

Opportunity:

- Resolution to J69 Producer Well: Tullow has not had an issue with its drilling since 2019 with recent drilling experience improving reliability and consistency, especially at Jubilee. The upside centres on the J69 well issues being an isolated issue and the Company can rectify/manage the pressure loss.

- Oil Price: As of June 24, Tullow had hedged c.70% of its H1 ’25 production, with only 10% hedged beyond that point. Any rise in oil prices will benefit Tullow. For FY25, Tullow has hedged 45% of its production with $59/bbl floors, with a further 27% capped though three-way collars with weighted average sold calls at c.$92/bbl and re-participation in the upside above c.$102/bbl on a weighted average basis. For the period from July 2025 to December 2025, three-way collars provide downside protection for c.10% of forecast production entitlements with c.$60/bbl weighted average floors and c.$89-$99/bbl call spreads on a weighted average basis.

- Low Operating costs: Tullow operates in large offshore fields and post-CAPEX, operating costs are c. $10-13/bbl. By bringing in-house the operational and maintenance contracts, Tullow has maintained these levels. For FY22, Opex was $11.30, down from $12.10 in the prior year. Although increased in FY23 to $12.40, FY24 levels should be below $11/bbl.

Risk:

- The main risk is production - which we discuss in further detail below. Tullow generates the majority of its production from the Jubilee field, heightening the operational risk.

- TEN field: Tullow has underinvested in this field in recent times, with production levels falling significantly over the last couple of years. Tullow, post the pre-emption rights, owns 55% of the TEN fields, and with CAPEX spending focusing on infrastructure on new segments of the oil field, a production increase is not likely to be seen this year.

- Ghanian Tax Liability: This issue has been rumbling on for some time and again highlighted in the H2 accounts. We have highlighted the bigger issues in detail below.

Production:

- A picture paints a thousand words, so attached are two pictures depicting monthly gross production at Jubilee and TEN fields in Ghana, with the solid black line representing production guidance. Production Guidance and actual production hasn’t varied, except for Jubilee in FY24.

- Tullow have encountered production issues following the J69 producer well, brought onstream in February 2024. There are issues concerning the pressure communication from water injection in this specific area. This has resulted in Gross production guidance at Jubilee reducing from 100k boepd in January to c.90k, with actual production for FY24 reported at 87k. (This is not verified by the Company, but from production figures shared by Ghanaian Petroleum Authority.

- More worryingly, as shown in the graph below, monthly gross production figures at Jubliee have fallen from 90k in July to 78k in December.

- This reduction in production in H2 2024 is more concerning considering that Tullow has reached the end of its drilling program in June 2024. Tullow plans to carry out a 4D seismic survey that will be completed in early 2025 to update the view of the sub-surface, support drill candidate selection and optimise well placement ahead of a 2025/26 drilling programme. However, there will be a delay in any new wells coming onstream, therefore relying on stabilising the current production levels.

Tax Liabilities:

- Details of each claim are stated below, but in summary, Tullow has won the first case. The two other outstanding issues with the Ghanaian tax authorities are due for the first hearing in FY25, although Tullow and the Ghana Revenue Authority continue to be in discussions. It is nearly impossible to evaluate the likelihood of success or otherwise for Tullow in these cases.

- The Bangladesh and other tax issues receive less coverage but are again mentioned in the FY23 Annual Report. The Bangladesh case was heard in arbitration in May 2024 with a decision expected in H1 2025.

The issues:

- Issue 1 - $320m. (Resolved in Tullow’s favour): In October 2021, Tullow Ghana Limited (TGL) filed an Arbitration request with the ICC disputing the $320m remittance tax assessment with the direct tax audit for FY2014, FY15 and FY16. The Ghana Authority is seeking to apply a Branch Profit Remittance tax against TGL. Both parties have agreed the first Tribunal hearing will be held in October 2023.

- Issue 2 - $190.5m: In February 2023, TGL filed with the ICC another request for Arbitration disputing this tax assessment. This claim relates to dis-allowance of loan interest for the financial years 2010 to 2020. The amount has been revised in December 2022, with the revised amount superseding all previous claims. No timeframe has been agreed for the first hearing.

- Issue 3 - $196.5m: In December 2022, TGL received a $196.5m tax assessment and payment demand concerning the corporate business interruption insurance policy held by Tullow UK. TGL again has filed a request with the ICC, disputing the assessment, with again no timeframe agreed upon for the first hearing.

- Bangladesh Litigation ($118m): This relates to the offsetting of development costs incurred by Tullow Bangladesh concerning future taxes. Arbitration proceedings were initiated under a Production Sharing Contract on 29th December 2021, with a procedural hearing held in June 2022. The first submissions have been made in October 2022, with the first Tribunal hearing scheduled for May 2024.

- Other: Other items total $294m comprise exposures in respect of claims for corporation tax in respect of disallowed expenditure or withholding tax that are either under discussion with the tax authorities or which arise in respect of known issues for periods not yet under audit. We are seeking clarity from the Company to ascertain which jurisdiction these refer to.

Recent Trading:

- Although the Company have not released H2 2024 numbers yet, the Petroleum Commission, Ghana have released production and lifting data for FY24 enabling us to confirm production numbers for FY24. Tullow’s trading update in November is a little more bullish than we can model, especially on free cash flow generation. The difference is likely to be working capital and the overdue gas payments from the Government of Ghana.

- Tullow has projected net debt of $1.4bn at year-end, versus our projection of $1.55bn but we will await full numbers before we adjust our model. We may be missing some further overage payments on the Uganda asset sale, but our view is this was not likely to materialise in FY24.

Kenya Option:

- Credit Investors stop reading here! For completeness's sake, we have included a couple of paragraphs of the Kenyan operations. However, we view this mainly as a potential equity upside and not of any concern to creditors in the short term.

- Tullow has been left with no partner on the Kenyan assets after Total and Africa Oil abandoned their stake. Tullow has a long-standing sales process which was halted in 2020 due to Covid and specifically a Force Majeure from its Joint Venture partners.

- Progress since then has been painfully slow, with repeated license extensions from the Government of Kenya. The latest, which was extended to December 2024 made some further adjustments to the Field Development Plan. Tullow continues seeking a strategic partner for this project. We have in the past valued the asset at c.$200m but with the repeated delays, maybe that is optimistic. Tullow valued the asset in December 2023 at $242m. We would not be surprised to see a further write-down in the Annual Report for FY24.

Happy to discuss further.

Tomás

E: tmannion@sarria.co.uk

T: +44 20 3744 7009

www.sarria.co.uk