UK assets, BBs, China vs. US, Friday 13ths

All,

What a day.

As all eyes are on UK assets this morning (unwind of Corbin short and Brexit better than uncertainty / euphoria) as well as BB new issues and US/China deal. Everything is up. Some random graphs to lend perspective to where we are.

UK Assets:

- So the UK have decided to take the leap. That should give a sense of direction and purpose. But it's a leap of faith and the destination remains unknown. Fundamentally, there seems to be something amiss on a day that sterling rises and the default rate drops simultaneously. With trade deficit widening and a decidedly less fortunate negotiating position (after the leap, in mid-air) for new trade deals with both the EU and the US, either sterling must drop or leverage rises. Unless of course growth sets in. But will that happen before we know which trade deals the UK will land?

New Issues:

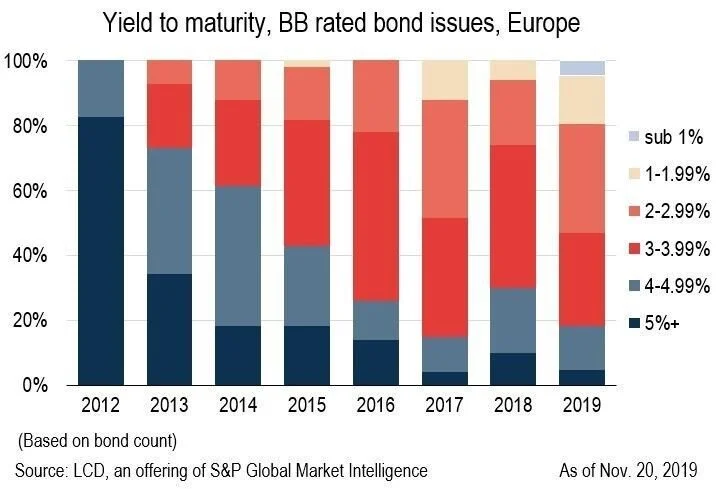

- Yields however reflect only half the story. We are about to have the third deal without the usual covenant tied payment restrictions on dividend distributions. After Refinitiv (Blackstone) and Envision (KKR), Kox Media documents (Apollo) are also trying it on.

US vs. China:

- Deal: USA to sell more agricultural goods to / buy more high-tech from China. Clearly that buys votes for next year, but isn’t it the inverse of what was supposed to happen? China to continue to deny US firms’ access to / subsidise key sectors and to rip old US tech out of their government (big government) offices. China’s central committee understands all too well how vulnerable (and defenceless these days) western democracies are to any threat to growth.

And here is a funny one - Friday the 13ths going forward: