Schmolz+Bickenbach may no longer have its bonds outstanding, but we have been keeping an eye out for the equity that replaced them.

The idea originally was to

Below is an account of each of the names we follow and have begun work on in the context of Covid19 and Oil prices. Several names stand out as having become either uninvestible or outright attractive - already now.

We are still waiting on the side-lines.

We got the order of magnitude right, but ultimately results were even worse than model and business is picking up more slowly - now even more so with the virus.

No major news here.

As per our previous notes we understand that

Please find our updated analysis here.

Further to our mail, Martin Haefner now controls just under half of S+B’s shares.

The families had not participated in the

the family did not participate in the rights issue, which resulted in Martin Haefner’s stake ballooning to 44.9%. Thus the CoC clause has been

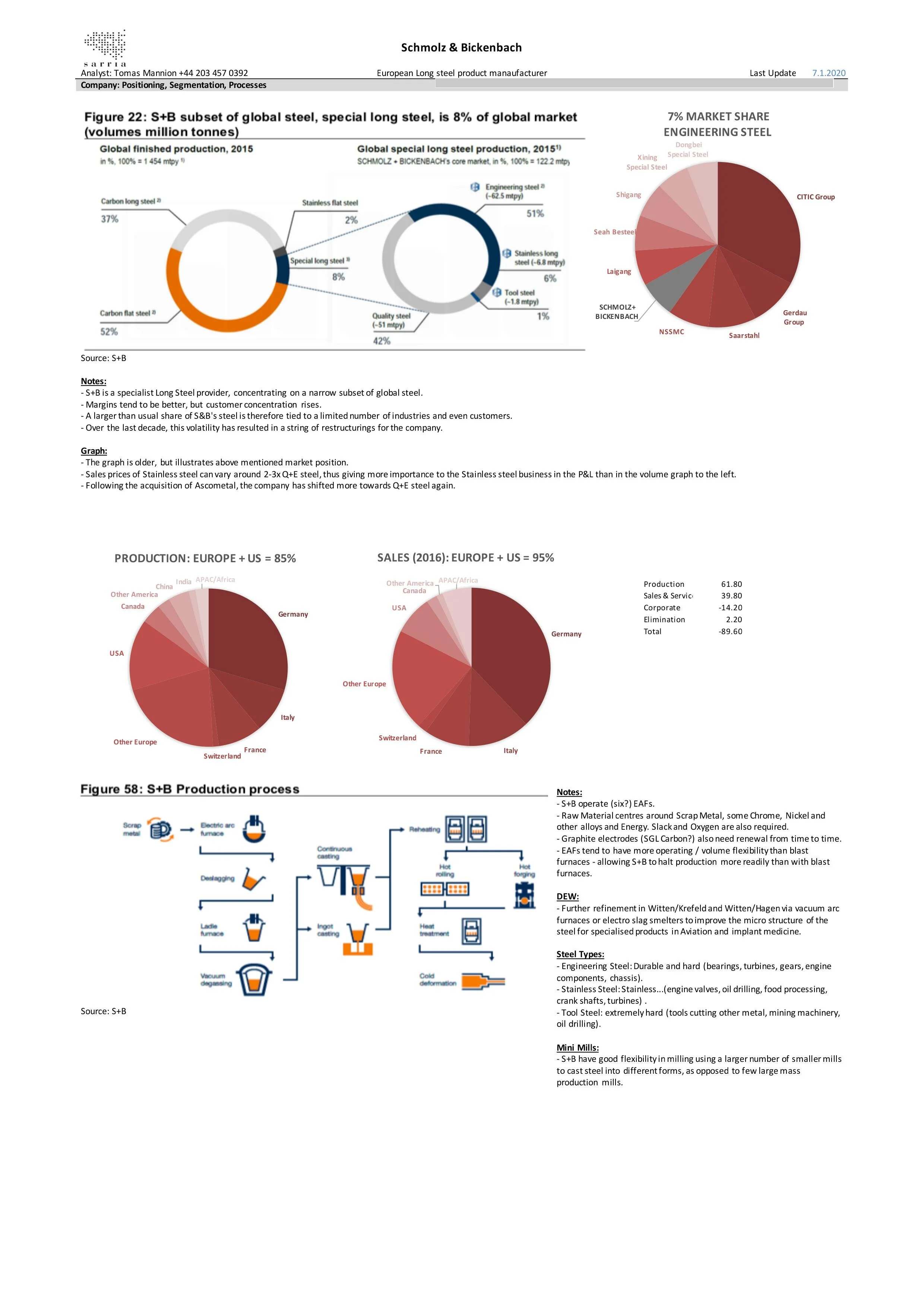

Please find our analysis of Schmolz+Bickenbach here.

We are not fans of the current CoC trade, but are fans of the

here are few news this morning in the company’s press release, except the more precise math of its rights allocation.

Observations:

- We are still not clear if

As was to be expected, the Swiss regulator has granted S+B a restructuring exemption, clearing the way for

Thoughts following another call with the company and with Liwet:

1) All is of course subject to the regulator’s decision to be communicated before Monday morning.

2) Haefner and the company calculate that only approx.

Some thoughts on Schmolz’ shareholder agreement yesterday:

1) It’s fundamentally positive to have any agreement at all.

2) The thus far continued opposition by FINMA to grant a restructuring exemption still makes

We have been going through plenty of game theory on S+B in the last weeks - admittedly with no single result that would have led us to taking a position.

There were two themes to Schmolz’ call today: downturn and CoC.

On downturn:- The company is clearly suffering from what is called the