We had been negative on the bonds early on and had not been fans of the business model, which has seen too much of its value added replicated by nimbler online competitors to cope with its vast capital

Business at the company has gone from bad to worse this summer and the fresh cash needed has kept rising, including an additional £200m requested earlier this month.

Sarria view: Remain positive on the Casino debt structure and the potential asset sales confirms Casino’s wish to de-lever and improve liquidity at Casino level.

Following press speculation in

We have been oscillating over this issue when it emerged that the SoA would only be used to set the voting thresholds lower.

As per our initial deliberations, the CH15 filing

Please find an update to our analysis of Thomas Cook here.

Following our analysis of the split of the capital structure and the implied valuations underlying the proposed deal, we have taken a look at the current performance of the business and what the current

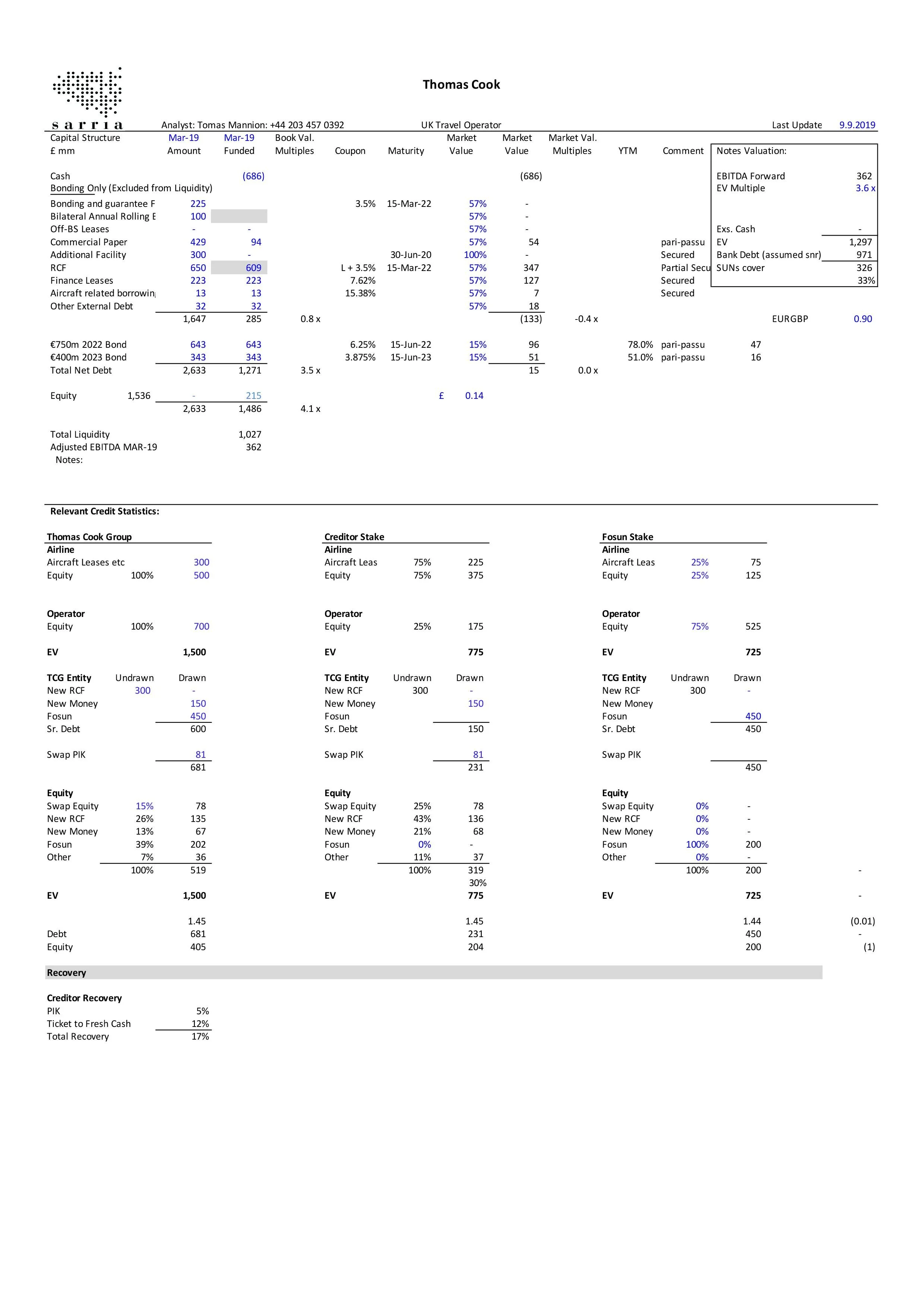

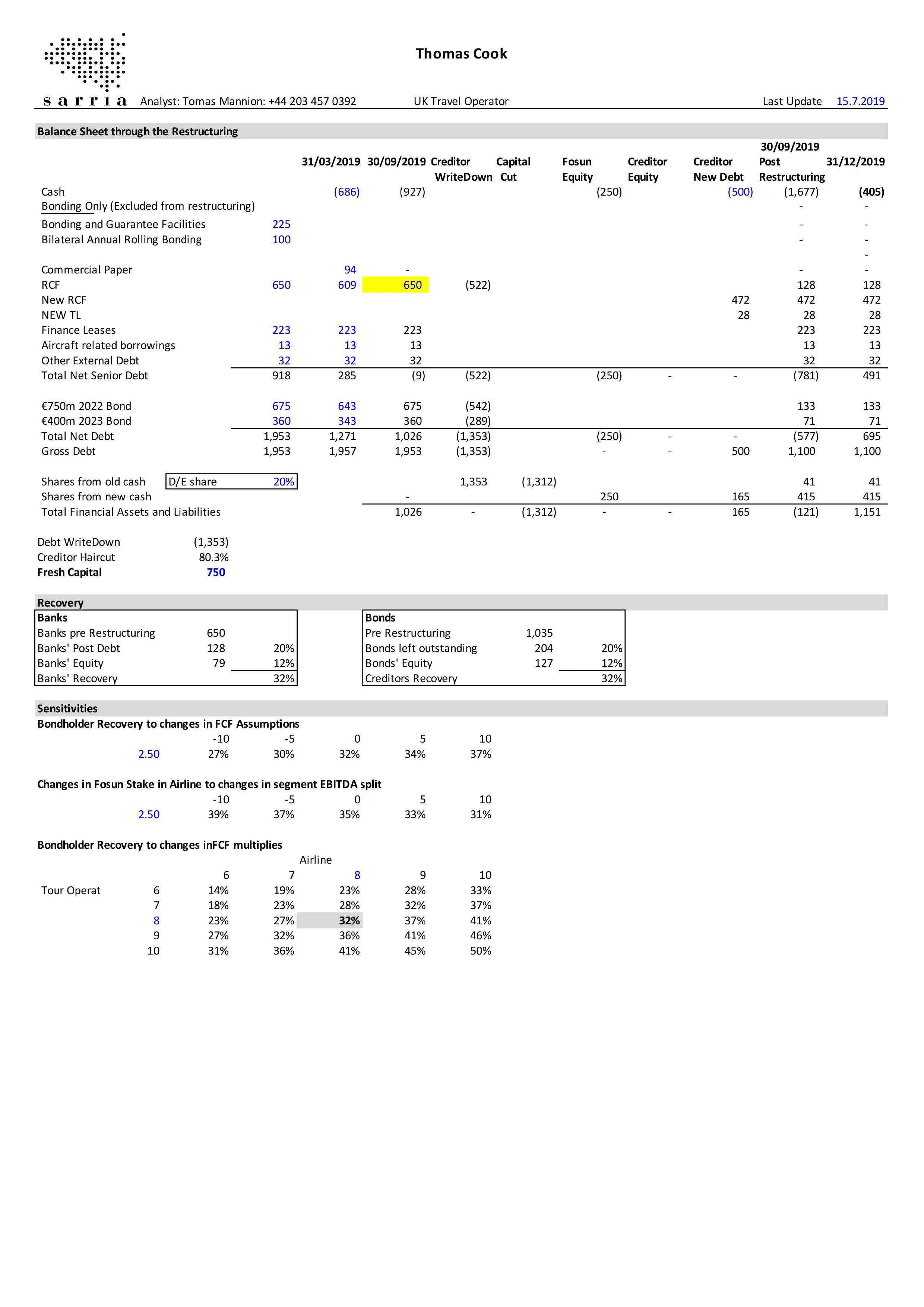

Please find a new TCG restructuring model here. The model back-solves for each entity’s implied EV, calculates the resulting recovery to the current bonds and splits out the relative future exposures of

Thomas Cook applied to the Courts on Friday 30th August, with previously unreleased details emerging. Below is further detail. We will send a restructuring model and recovery calculations tomorrow.

further to our email this morning: CDS is ultimately still set to be triggered.

- Contrary to our initial assessment, the primary motivation for merely changing the voting threshold via the schemes is not to avoid a trigger under the CDS

Some important detail in the fine-print of TCG’s Skeleton Argument filed with the court:

CDS: The news that the court approved the schemes to proceed on 18th of Spetember were not overly spectacular. However,

Thoughts:

- Really the only news is a more precise announcement of the Equity split between Fosun and creditors across the two businesses. The impact is

Thomas Cook released a short RNS this morning, stating negotiations are continuing and are in discussions with 50% of the bondholders. It appears that the Company

Thomas Cook are reportedly seeking another £150m on top of the £750m already announced.

Interestingly, Fosun’s share of investment under the

On the Beach Group have issued a trading Update this morning with profit warning for FY19 due to currency headwinds from Sterling weakness. This is not new news but acknowledgment

Neset Kockar - Turkish hotelier and tourism airline operator is aggressively buying Thomas Cook shares. He crossed the 5% threshold last night and is now at 6.7%.

Tomas believes

This should further highlight the desire of creditors to keep TCG as one Group in the immediate future. Fosun will want to carve out the Tour Operator for their capital injection but creditors should remain

Having done further work on TCG’s legal structure last week, we have come to the conclusion that under the current terms including Fosun, a restructuring will likely trigger CDS after all.

Intermediate holdings:

Whether or not 2019 CDS will be triggered may not so much depend on ‘when' the company restructures, but ‘how'.

Further to a note from GS this morning, we think some of the points have merit:

Please find our updated analysis of Thomas Cook here Also included is a new restructuring model where we are separating the operator

We have been playing with a model on TCG to simulate the split between the two segments and allocate cash injections, write downs, shares and recoveries.

The expected:

TCG have given a statement according to which summer tour bookings are down -9% and airline sales down -3%, despite a price rise of 2%.

According to the Spanish press article below, Hotels in the Baleares are saying that TCG's reverse factoring providers have pulled out.

Just a thought this morning on the news that TUI have opened a shop inside Next in Sheffield.

What if Thomas Cook, Pizza Express and New Look moved together?

According to (so far very well informed) Sky News, PWC has just been appointed by "the bonding providers”. Ae are uncertain if this is a reference to the

In light of a TCG lender selling a significant strip of Super Sr. Loan, RCF and LC, we have spent some time with counsel and advisors this morning on how we see this play out.

TCG are saying the company was approached by its 18% shareholder Fosun and go on to say they are in discussions on the tour operator.

We have had a great ride with Thomas Cook, but we feel it is time to close out the trade and wait on the sidelines for a bit. Upside and downside appear relatively balanced from here and

Results out this morning.

Two key notes:- Airline sale - have received multiple bids, including for the whole airline. Currently assessing the bids and will provide update in due course.

As expected, the TUI reporting this morning reveals a weak H1 (October - March). Rad-through for Thomas Cook:

1) Knock-on from Summer 2018 heatwave. Consumers had had enough sun for the year

In light of today’s deadline for preliminary bids on TCG’s airline, Lufthansa have made the below comments to Reuters at their AGM:

"Germany's largest airline Deutsche Lufthansa will make a non-binding offer for Thomas Cook's Condor with

According to Sky news: https://news.sky.com/story/struggling-thomas-cook-flies-towards-400m-bank-deal-11710248 E&Y have ordered TCG to go raise another £400m if they want sign-off