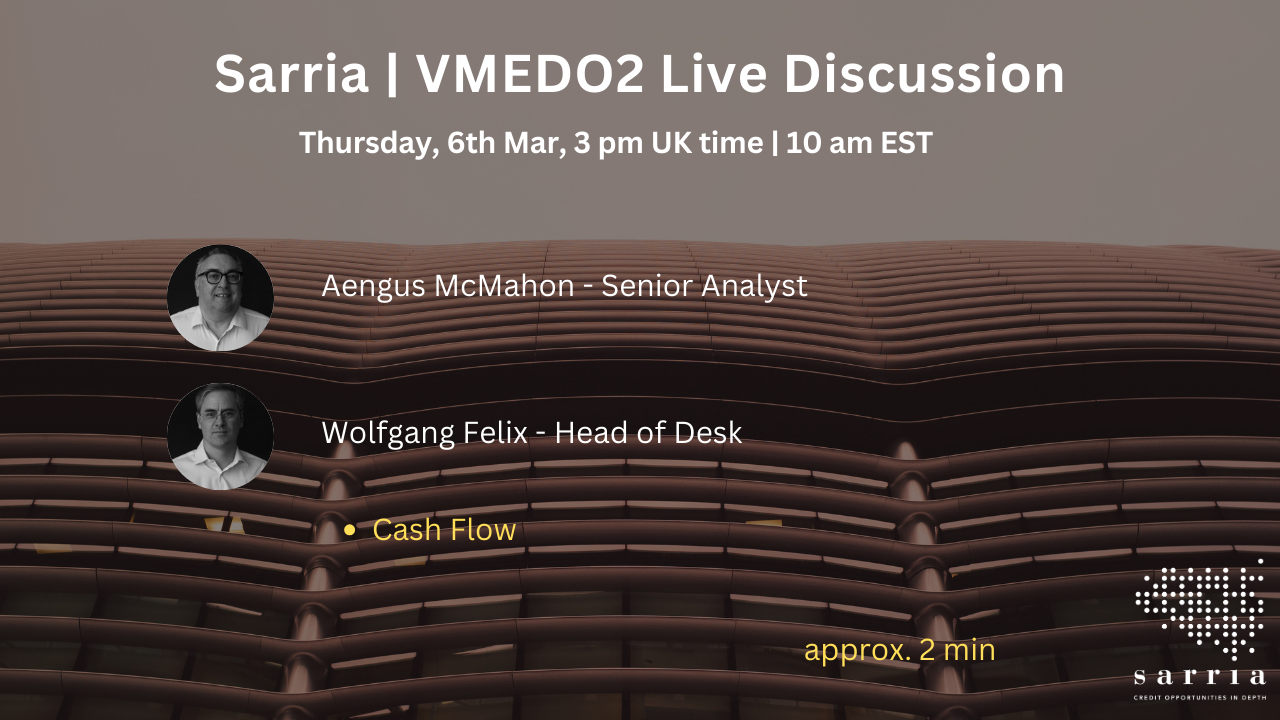

- Below is the VMEDO2 Live Discussion, edited into smaller videos for your convenience - for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution -

Intro, Legal and Cap Structure - 6 Mar 25

Industry and Segments - 6 mar 25

CTIL - 6 Mar 25

Cash Flow - 6 Mar 25

Investment Discussion - 6 Mar 25

VMEDO2 Live Discussion videos are available on the website, here.

All,

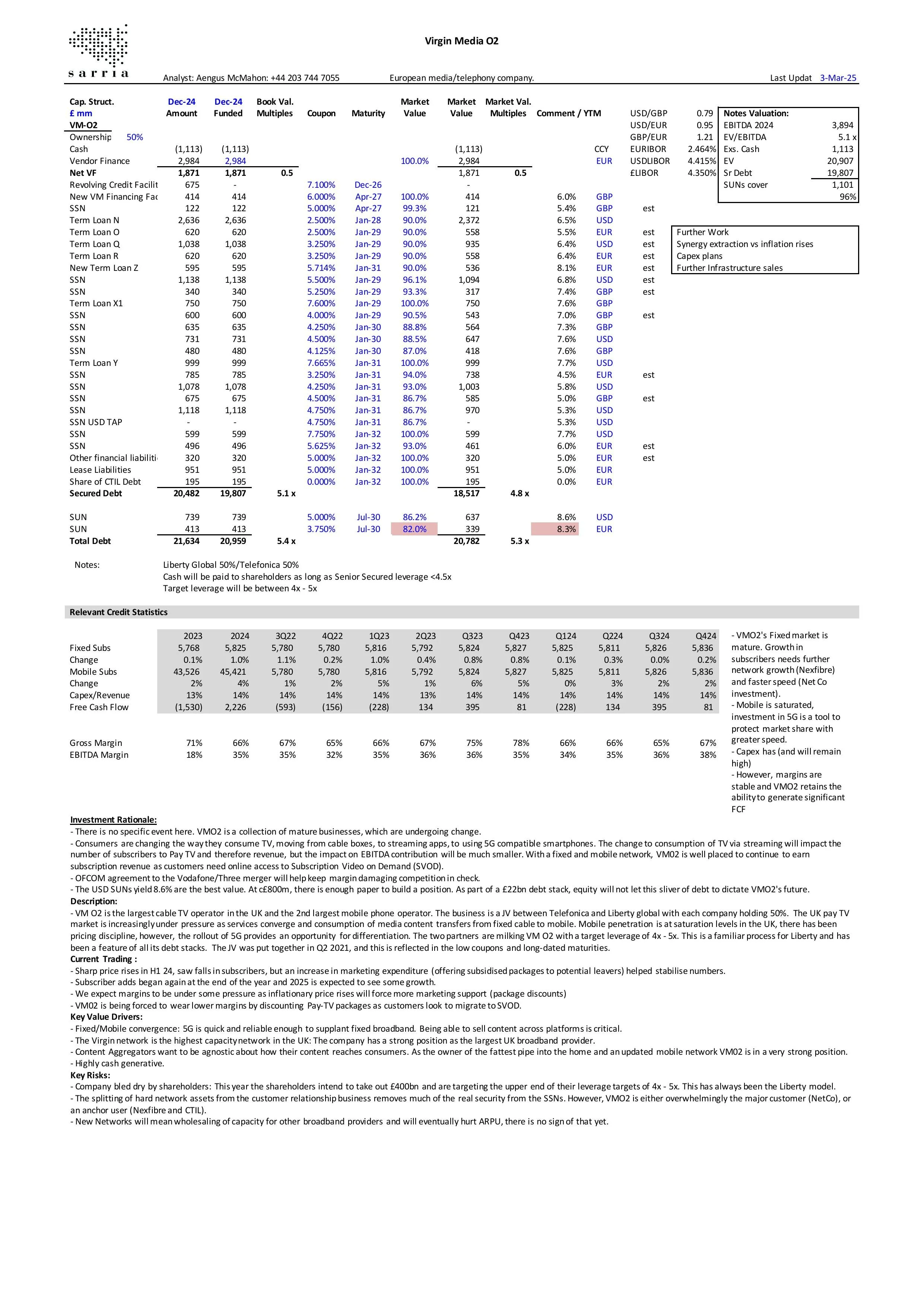

Please find our updated analysis here.

Sarria | VMEDO2 - Live Discussion

Thu, 6th March, 3 pm UK time | 10 am EST

The company met its muted 2024 guidance but did show subscriber growth in the final quarter. We had expected top-line friction as higher prices caused customers to

The confirmation of the sale of another 8% of its tower business was expected and reported in the FT in September. VMED is shifting

CEO Lutz Schüler is on medical leave for up to 8 weeks and will be replaced temporarily by the CFO; he is expected to

A further sale of VMED’s stake in the towers business has been on the cards, and the additional £150m - £160m will reduce the debt portion of

VMED dropping any objections to the Vodafone/Three merger is no shock. The UK market is saturated, but a price war is unlikely as all

No significant change in Q2 at VMED. Guidance has been firmed slightly in revenue but EBITDA is still expected to fall

An extension of the network-sharing agreement with Vodafone is a slight positive for bondholders. The extension depends on

Placing a €600m SSN inside 6% demonstrates that investors are still

VMED O2 hasn’t yet launched new services on its upgraded Fibre to the Premises (FTTP) network upgrades. Only £100m of what we estimate at £1.7bn in

Investors are familiar with the name and the strategy of sending any excess cash to the parent, so the downgrade at VMED (from BB- to B+) will only have

Telefonica’s impairment charge on its Virgin Media o2 (VMED) stake reflects the reality of higher rates in the UK. VMED had already guided for

Splitting its network from the customer base will allow Liberty/Telefonica to release some capital by inviting Infrastructure investors in. Also, in addition to

2024 guidance shows a sacrifice of EBITDA to protect its customer base. The 8.8% rise in consumer bills will lead to customer cancellations, and

If Virgin Media o2 (VMED) buys the consumer division of Talk Talk it will acquire 2.4m broadband customers, and we estimate a price of around

Please find our updated analysis here.

Virgin Media O2 (VMED) is a structure now familiar to European investors. A JV that makes regular payments to the parents to maintain a leverage range. As long as EBITDA continues to increase, everyone is happy. Cable/Mobile revenues may not be

The launch of a $500m TL by Virgin Media O2 (VMED) was prompted by its dividend policy. In June, VMED drew £325m in term loans to fund a dividend

The acquisition of UPP does not change the risk profile of Virgin Media O2 (VMED). The purchase price is modest in the context of

A 1% rise in underlying revenue was due to additional mobile customers balancing reductions in the Consumer business. Customers are churning off