(Debtwire) PizzaExpress liquidity offers respite but significant leverage and tight cashflows provide challenges

01 September 2023 | 10:33 BST

PizzaExpress operations are in a difficult spot. Net leverage metrics have crept higher while cashflows off current modest LTM earnings look thin. But the UK-headquartered pizza chain has robust liquidity and time to grow earnings ahead of medium-term maturities. This leaves time to execute on a possible refinancing down the line though a substantial OID may be required to get any new bond over the line and quarterly trading faces risks, according to three buysiders.

The company reported 2Q23 results for quarter-end 2 July on 29 August with EBITDA falling 10.5% year-on-year to GBP 10.2m, as reported. The results meant that company 2Q23 LTM EBITDA was just GBP 53.2m with reported net leverage up at 5.3x (excluding IFRS 16).

Deleveraging in the near-term looks tough based on projected free cashflow generation. With a 2Q23 LTM EBITDA of GBP 53m, it could face investor projections of GBP 20m-GBP 25m total capex, GBP 22m interest, minimal cash taxes and a possible GBP 9m of exceptional items would which imply negative GBP 3m to positive GBP 2m of free cashflow ahead of working capital swings. Management added on the earnings call that there had been a working capital outflow in 1H23 but that this is expected to reverse and build-up in 2H23 and leave the cashflow impact from working capital swings as flat at year-end FY23.

One positive for investors is that an element of the company’s capex is discretionary and can be cut back if operations deteriorate. PizzaExpress in FY22 spent GBP 7.3m in refurbishment capex, GBP 4.7m in new restaurant capex, GBP 5.5m in maintenance capex and GBP 1.6m of other capex, illustrating how some expenditure can be cut back if required. The company typically has an annual GBP 8m-GBP 9m maintenance capex requirement with GBP 140,000 average refurbishment capex per restaurant. A portion of the estate has not been refurbished for over 10 years but around 50% of restaurants are expected to have been refurbished by year-end as part of the recent refurbishment program that started two-to-three years ago.

Management gave further colour on its effectiveness of its capital expenditures on the earnings call, adding that refurbished restaurants had 6%-8% sales uplift and that the return on invested capital target is to have a two-to-three year payback.

The group also has a solid liquidity position with GBP 79m total liquidity at 2Q23 including full access to its undrawn GBP 30m RCF (though GBP 4m is blocked against an electricity letter of credit) and a cash position of GBP 51m. Management do not expect to have to draw on the RCF to meet interest payments according to indications on the 2Q23 earnings call.

The liquidity position provides flexibility for PizzaExpress to therefore execute on its earnings growth strategy. However, 3Q23 trading could again be tough given management guidance. Management noted on the 2Q23 earnings call that post-quarter-end current July trading was a reasonably buoyant time but that August trading was more difficult due to the weather, strikes, and UK consumers leaving the country to travel given a large amount of wet weather.

One positive take-away from the earnings call was that sales in July and August were made at full prices without any discounts except for consumers who had a Tesco Clubcard or those that were part of the company loyalty program. Another additional positive was that the company had hedged over 60% of its energy costs for 4Q23 and going into 1Q24 with 100% hedged to the end of 3Q23.

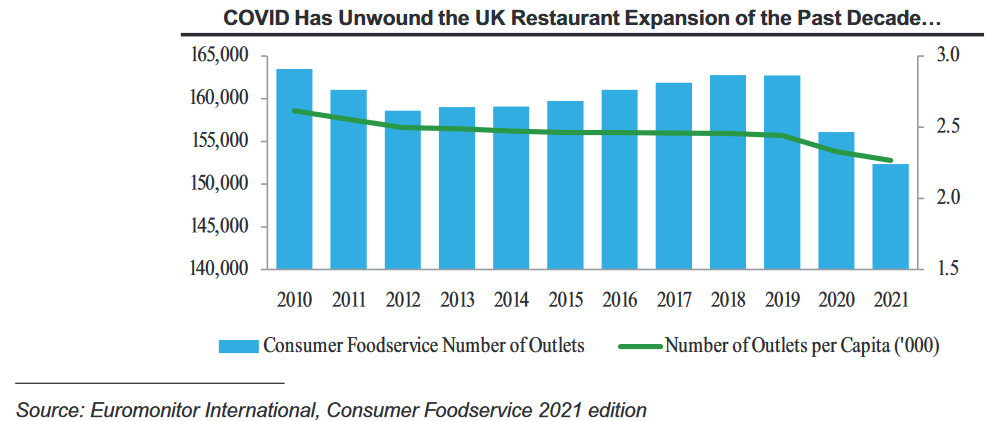

Operational risks remain given intense competition. However, positively, UK and Ireland operations have beaten the market (as per Peach industry data) for 32 out of 33 weeks in 2023 with one miss due to a heavy promotion in the prior year. Competitor Italian dining players also suffered during the coronavirus pandemic. Zizzi, Pizza Hut, Bella Italia, Prezzo, Ask Italian and Frankie & Benny’s recorded a reduction in the number of outlets of 17%, 18%, 20%, 35%, 43%, and 55%, respectively between January 2019 and December 2020 (according to FutureFoodservice, The Rebuilding of Hospitality, 2021-2025) according to the PizzaExpress bond prospectus. Lockdowns during COVID-19 reduced the number of competitor expansions (see chart below from bond prospectus).

A graph with blue and green lines

Description automatically generated

“The biggest long-term issue is how this company makes profit given the economics are not so strong. They have good footfall in certain locations but the footfall is not uniform in all the locations,” one buysider said. “There is the high fixed costs which is the rent and they can’t really cover these costs so there is weak cashflow. Variable income benefits are not there and they need to drive footfall. They can do this by cutting prices but this won’t be so effective for profitability.”

The buysider added that some restaurants, such as some in places out of London for example, are poorly presented. He added that there is a lack of incentive for staff to make restaurants a success given most are on minimum wage and do not have such great performance incentives. Additionally, there are a number of third tier category restaurants where some are loss-making and this tail of unrefurbished restaurants hampers PizzaExpress.

“We were in the name previously and sold-out a while back. The concern is that net leverage is high and it is a tough one. The leverage has crept up but the bond prices have been relatively stable,” a second buysider said. “COVID meant peer Jamie’s Italian was wiped out but Italian food is a popular space and you can bring your family or even do a date night there with the brand being strong. Competition has lessened in this space.”

PizzaExpress still has time to grow into its capital structure with its next debt maturity being the GBP 30m undrawn RCF that matures in January 2026 ahead of its GBP 335m senior secured bond maturing in July 2026. A straight refinancing could be possible with the company keeping a low coupon but issuing new notes at a large OID with proceeds used to tender for its outstanding bonds above its trading prices.

“The RCF maturity is January 2026 and they will have to do something with the RCF even if it is undrawn currently. There could be a refinancing in early 2025 so they have over a year to a year and a half to grow into the capital structure but it depends on December trading,” the second buysider said. “The UK consumer environment could improve given food inflation is lower and people have more money.”

The second buysider added that PizzaExpress could do what [UK frozen food retailer] Iceland did and do a below par tender and a refinancing. Leverage is going up but if it comes down to 4.5x he thinks they could refinance given it was below this level previously. He noted however that any refinancing will require a large OID as the company can’t afford a massive coupon.

PizzaEx-stress

The company emerged from its previously restructuring with a much lighter debt pile, a star-studded new management team, and a focus on its core UK business following the divestment of its Chinese operations, as reported.

A US bankruptcy judge granted Chapter 15 recognition of PizzaExpress’ UK restructuring plan in early November 2020, as reported. The company received approval of its restructuring plan in UK court on 29 October 2020, after three classes of creditors had voted in support of the plan. Under the restructuring plan, holders of senior secured notes were set to receive 63% of the reorganized company’s equity, a series of new notes with a reduced principal amount of GBP 200m, and the option to participate in a GBP 144m new-money facility that would be provided to the debtor in exchange for an additional 35% equity stake. Holders of unsecured notes received a 1% equity stake, while a GBP 71m super senior facility remained in place at the top of the capital structure.

The workout meant the company’s outstanding debt had been reduced by over 50%, with bondholders taking the keys. As of 25 May 2021, the entity Wheel Topco (parent of issuer entity Wheel BidCo) was 17.4% owned by Bain Capital, 25.1% by Cyrus Capital and 10.3% by H.I.G Capital with the remaining 47.2% held by other bondholders. Previous sponsor Hony Capital and other shareholders were left with just 1% of the share capital of entity Wheel Topco.

Please click HERE for more details on PizzaExpress' previous Chapter 15 restructuring in Debtwire's restructuring database (access required).

The change of control covenant has portability below a 3.85x net leverage ratio test. Additionally, aggressively, payments from the Build-Up Basket are only blocked by an Event of Default, not a Default, allowing value to leave the Group at a time when an Event of Default is imminent (for example during the 30 day grace period following a missed interest payment on the Notes) according to a report from Debtwire’s sister service Xtract Research.

PizzaExpress’ B3/B-/B rated GBP 335m 6.75% senior secured 2026s are indicated at 82.75-mid with a 14.3% yield to worst and 837bps z-spread on Markit.

Based on assumptions in a Debtwire 1Q23 credit report and in a distressed scenario in FY23E (a 30% probability), Debtwire analysts calculate a recovery value of 65% (base-case scenario) for PizzaExpress’ total debt, comprising the super senior RCF (assumed to be fully drawn) and senior secured notes.

Click HERE for the Debtwire 1Q23 PizzaExpress credit report.

The first buysider noted that [Spanish pizza chain] Telepizza had a restructuring and was a similar concept even if it was more emerging market focused. He argued that a number of companies rely on footfall with [Swiss-headquartered vending services provider] Selecta, which also restructured, also being reliant on footfall, adding that these kind of businesses can end in dangerous places.

“We are still talking about the UK’s number two pizza chain and if this is the nadir of the affordability crisis, then the capital expenditure and inflation might allow for sales growth of 10% per annum now. To then refi in two years they’d also need to produce a margin uplift of 5%,” independent special situations firm Sarria said. “Margins are low and going lower, so that’s perhaps the biggest question, but it’s not impossible at all and if in 2026 the shortfall is limited, we’d expect shareholders to support with fresh cash. For now, you can short the bonds from quarter to quarter, but it’s too wide and too far from any event to talk about recoveries.”

PizzaExpress was 5.5x net levered at 2Q23 according to Debtwire analyst calculations (see analyst capital structure below).

A screenshot of a computer

Description automatically generated

PizzaExpress declined to comment.

by Adam Samoon with capital structure by Neha Phatak