(Debtwire) Vivion liquidity tightens as options considered to address upcoming EUR 183m 2024 stub maturity

21 September 2023 | 16:17 BST

Vivion’s adjusted loan-to-value climbs when making proportional adjustments for its 51.5% ownership of subsidiary Golden, while readily accessible liquidity is stretched as upcoming 2024 maturities approach. But the Luxembourg-headquartered real estate investor successfully completed its exchange offer and has a variety of solutions it can implement to bolster its balance sheet, according to two buysiders, with two more buysiders cautious.

The company held its 1H23 earnings call yesterday (20 September) after reporting 1H23 results on 13 September, as reported.

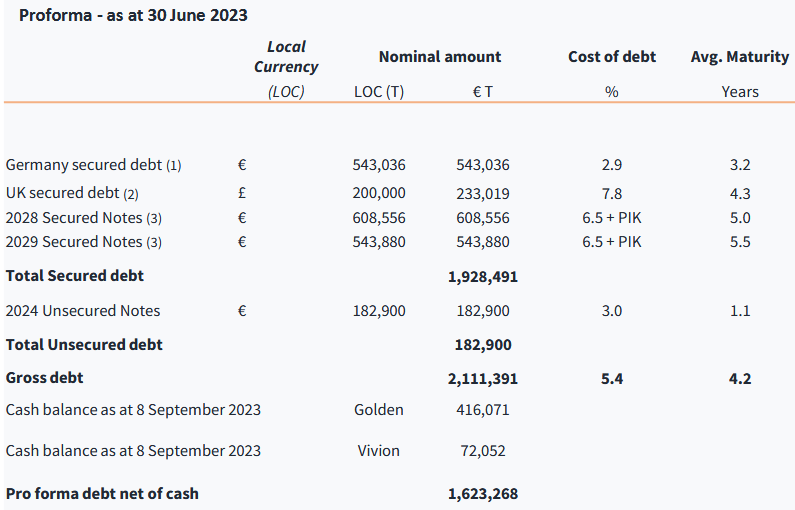

Vivion recently made significant progress in tackling its maturities with an exchange offer back in August, enabling it to refinance EUR 1.3bn of debt with an extension of its average debt maturity to 4.2 years (pro forma 30 June 2023). The company exchanged outstanding 2024 unsecured notes, 2025 unsecured notes as well as convertible bonds due 2025 in return for providing a cash consideration and offering a switch into new secured notes due in 2028 and 2029. As much as 71% of the existing 2024 maturities and 100% of the 2025 maturities were exchanged as 91% of the holders across the three series supported the maturity extension. The EUR 1.3bn transaction was significant given the backdrop of tough conditions for real estate companies to refinance debt burdens given the relatively high interest rate environment.

The company still has EUR 450m of debt maturing in 2024 including EUR 183m of senior unsecured 2024 note stub holders of which didn’t consent to exchange, as well as EUR 267m of secured debt. Management explained on the 1H23 earnings call that the EUR 183m stub piece can be tackled with excess liquidity through bond buybacks in the open market or via a tender offer, possible equity issuance through private placements or joint ventures, the issuance of new bonds or a tap if primary market conditions improve, or a disposal of non-core properties.

Addressing the upcoming maturities through using existing liquidity could be tough given the tight cash position. The company had a consolidated cash position as of 8 September pro forma the completed exchange offer of EUR 488m, though just EUR 72m of this was unrestricted cash at the Vivion level with EUR 416m of cash being held at the Golden subsidiary which is 51.5% owned by Vivion.

It was explained on the 1H23 earnings call that if a hypothetical EUR 200m of cash was moved up from Golden to the Vivion level, then some EUR 97m would have to be paid to the Golden minority shareholders which means there will be cash leakage when moving any cash from Golden.

Upcoming shareholder loan repayments will reduce group liquidity going forward versus FY22 numbers. Subsidiary Golden repaid loans to shareholders in June 2023 on a pro rata basis in an aggregate amount of EUR 100m. Additionally, it was noted that Golden intends to make further repayments of shareholder loans in its discretion of up to EUR 100m to its shareholders on a pro rata basis in the course of 2023 subject to the acceptance ratio of the completed exchange offer to holders of the 2024 and 2025 senior unsecured notes, according to the exchange offer documentation.

It had been suggested to investors at the recent Goldman Sachs Annual EMEA Credit and Leveraged Finance and JPMorgan High Yield and Leveraged Finance conferences that Vivion could address its 2024 stub piece by considering disposals such as its UK hotel portfolio or through elevating Golden minority shareholders up to the Vivion level, one buysider noted.

“Minority shareholders will want the value of the UK assets Vivion gives access to, so the company can’t just sell the UK hotel portfolio to generate cash if it wants the minority shareholders at the Vivion level,” the first buysider said. “The minority shareholders will want the better UK hotel asset portfolio, but if this is sold there will be nothing left for them. If cash is taken from Golden, the minority investors will have to be paid.”

There remain a variety of other options at the company's disposal, according to market participants. The company could take the cash from Golden, but this would mean cash leakage to minority shareholders. Vivion could also raise a shareholder loan from Golden. A minority stake investment partner could also join forces and raise liquidity. Shareholder and founder Amir Dayan could also inject cash. Finally, there could also be another exchange offer to take out the remaining stub noteholders.

Raising a minority stake could be a plausible solution. The company's base listing particulars noted that Vivion Holdings holds 90% of the company, but the remaining 10% was held by the Vivion minority investor which became a shareholder in the company in June 2022 and increased its shareholding in July 2022. The company’s minority investor is Bow Street Special Opportunities XVIII SPV Cayman, LLC that had provided EUR 85.5m of shareholder loans to Vivion as of FY22.

Disposals could also be significant. The company’s portfolio had a gross asset value of EUR 3.9bn at 1H23 versus around EUR 4.0bn at FY22. The valuation reduction was mainly due to yield inflation and the entire portfolio was reassessed at 30 June 2023 by third-party appraisers including Savills, JLL and PwC. UK assets had a gross asset value of EUR 2.034bn while German assets had a gross asset value of EUR 1.892bn according to the company’s 1H23 investor presentation.

Vivion’s BB- rated EUR 183m 3% senior unsecured 2024s are indicated at 91-mid with a 14.5% yield to worst on Markit. The bonds are redeemable at par. A tender for the bonds below par could be an option, but a buyback at a 95 cash price, for example, would only generate around EUR 9m of interest savings which is relatively insignificant versus a net debt position pro forma the exchange offer of around EUR 1.6bn.

The first buysider noted it is a tough situation, adding that, in his view, the new notes coupon was the maximum Vivion could afford. He argued the cash may not be there to take out the 2024s and the game was to pay this down by selling the UK hotel portfolio. However, he queried who would be the buyer for this.

“They've managed to get the tender away. It is true there was not enough cash at the Vivion level and Amir Dayan had to give up some of Golden’s cash pile to keep control of Vivion,” independent special situations firm Sarria said. “Cash is king these days and this will cost him access to some future opportunities, but it’s an obvious choice.”

Sarria noted that Vivion can deal with the 2024 stub through raising debt on unencumbered hotels, or by selling hotels, one of the few asset classes currently worth anything in the UK. Sarria argued Vivion have got half a chance there and raiding Golden again is now more of a fallback option.

The Golden handshake

Vivion reported a low net loan-to-value ratio of 41.4% as of 1H23 pro forma its exchange offer. The LTV figure had previously been viewed as understated by some market participants. The figure was given at above 70% at FY20 by Everest Research, which had made adjustments including one to reflect that Vivion only owned 51.5% of subsidiary Golden Capital through which the German Portfolio was held (Vivion's LTV fully consolidates Golden), as reported.

The new secured notes terms and conditions included a group loan-to-value covenant of below 53% on an incurrence basis, and also a maintenance group loan-to-value covenant of below 65%. As part of the consent solicitation exercise, the terms and conditions of the 2024 unsecured notes were amended so that the secured loan-to-value and maintenance of unencumbered asset-ratio covenants were removed, and the consolidated coverage ratio was adjusted to 1.20x.

Vivion made no acquisitions in 1H23 due to the uncertain market conditions. Occupancy rates were stable across the portfolio and remained high at 95%, while over 90% of its rents are inflation-linked.

The company's BB+ rated EUR 608m 6.5% plus PIK senior secured 2028s are indicated at 75.75-mid with a 15.4% yield and its EUR 544m 6.5% plus PIK senior secured 2029s at 74-mid with a 15.4% yield. The new notes are both non-call one (NC1) which leaves open the prospect of the bonds either being redeemed relatively soon if interest rate reduce and primary conditions improve, or alternatively a scenario where the company can tender for the bonds above market prices.

A second buysider noted many holders had no choice but to exchange given he felt the original covenant documentation was relatively loose.

“A dividend was taken out in 2022 and this meant bondholders were misled,” the first buysider said.

Vivion’s exchange offer was marketed with an enticing low loan-to-value ratio and decent interest-coverage ratio. But the outstanding 2024 stub piece could consume further liquidity, as reported.

The Vivion capital structure at 1H23 pro forma its exchange offer is broken down below (based on the company investor presentation).

A screenshot of a document

Description automatically generated

Source: Vivion 1H23 financial report

Vivion declined to comment.

by Adam Samoon and Claude Risner