The company has announced the full subscription of its rights issue, which in the case of its shareholder structure is hardly surprising. It does however

- DELAYED - Accounts this morning (Aug 31st) confirmed that the Wyoming contract has been extended and otherwise operations have been stable.

Intralot have been / will be reporting their FY2022 results today. From what is out so far, the last quarter has been uneventful and caps a year that saw the

The quarterly calls have become shorter and sweeter. The equity cash in, the Inc. is refinanced, the EM business is running, new contracts are coming and even Argentina and

Yesterday’s call has been uneventful - a welcome change for the company and investors alike. In brief, there have been no more operational disasters and the

Following its recent share placement, the company has now redeemed the 2025 bonds, which it created last year in the context of its restructuring. This puts Intralot

Sokrates Kokkalis has been seen to be consolidating his holdings more directly in his name from 28% to 32%. This should have

Following the re-purchase of the equity in Inc., Intralot are refinancing the US bond with a term Loan, a structure that looks altogether more v

T’is done. Intralot have successfully executed their 38% rights issue, which gives Standard General approx. 20% in the business. The company remains in control of

Please find our unchanged analysis here.

Ahead of next week’s call, we are giving some thought to the impending share sale and how it wold be changing the company perhaps even more profoundly than

Please refer to our updated analysis here.

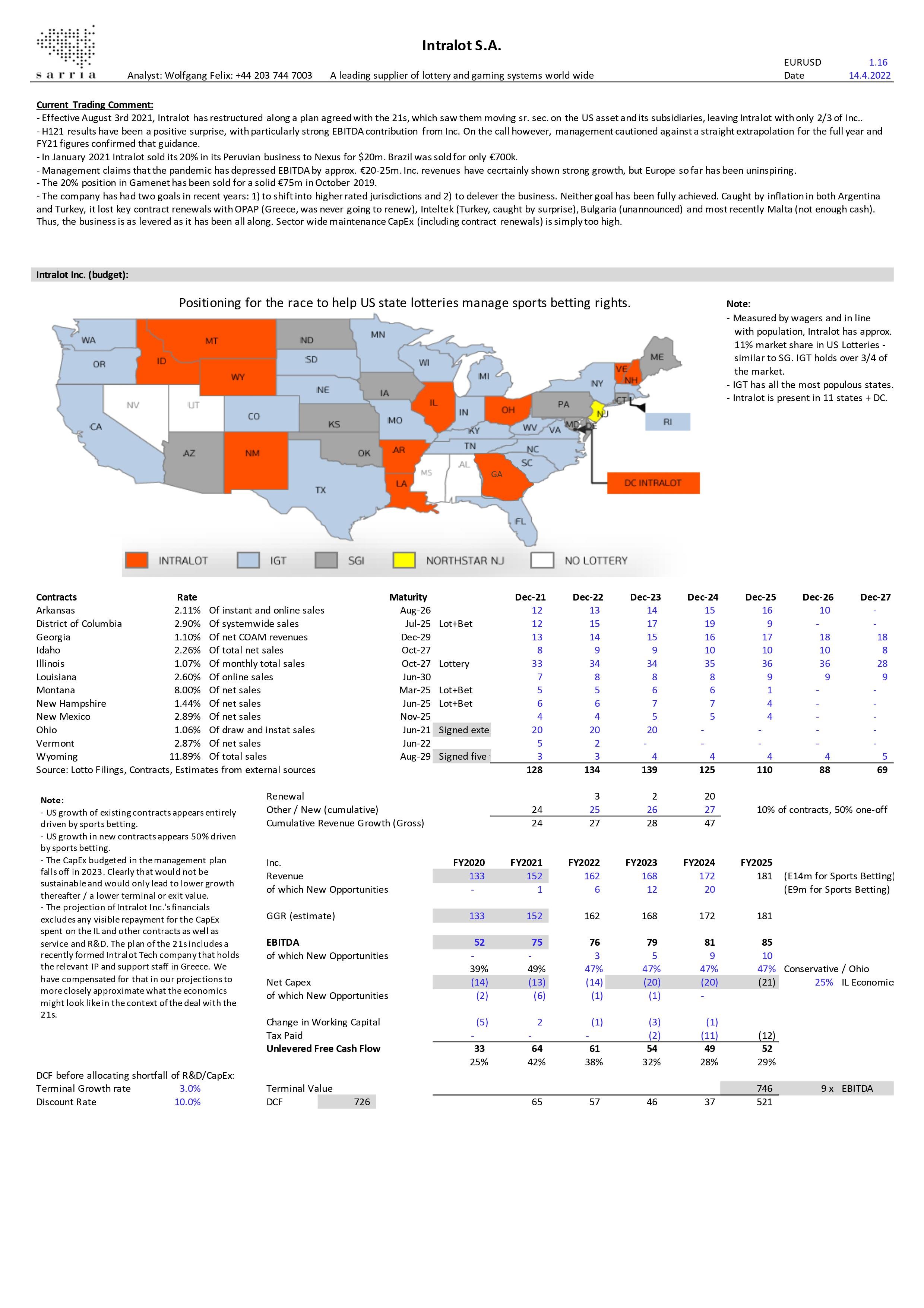

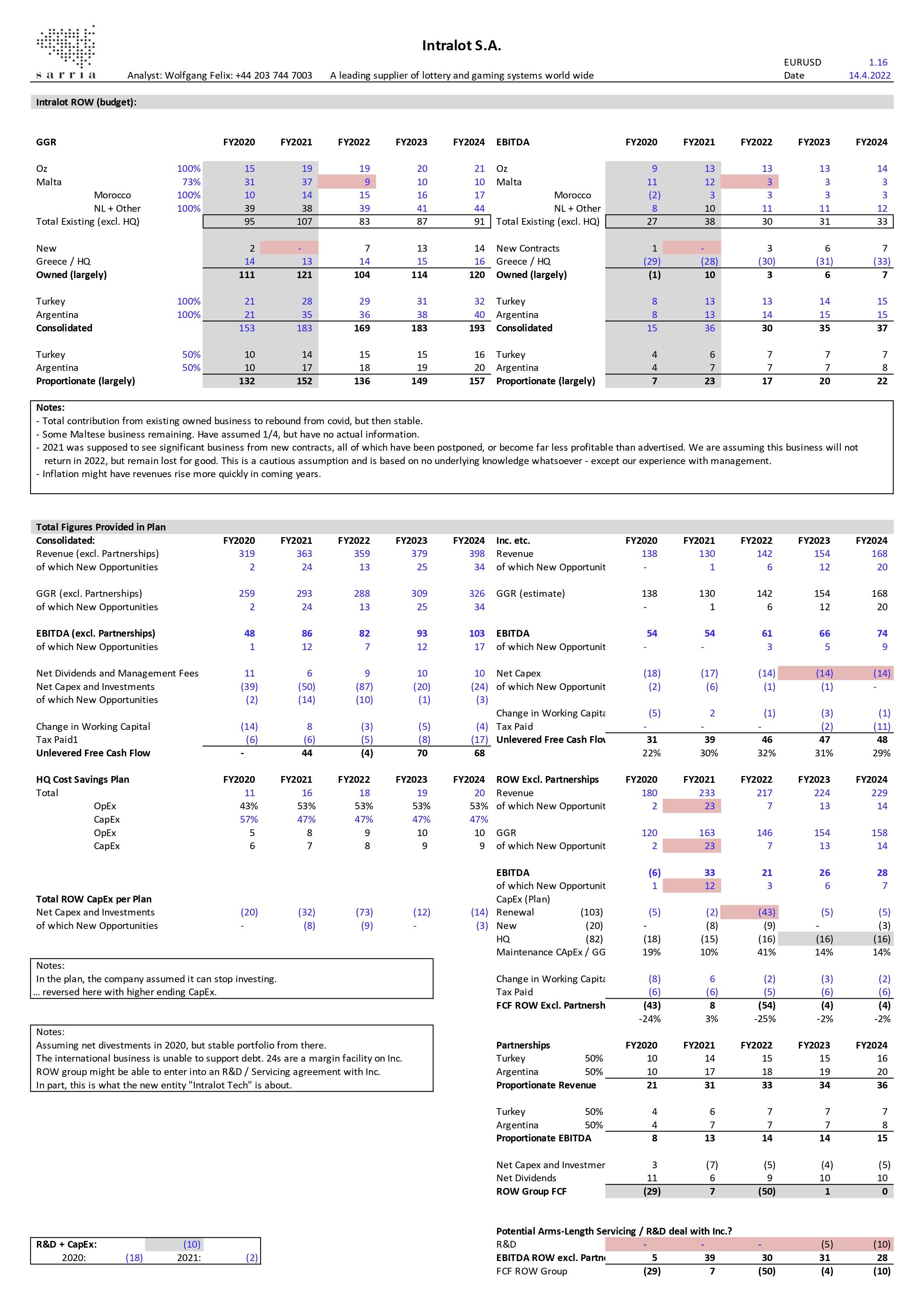

That the budget management handed down this time last year was nonsense was clear before we received it. Today we are of course still waiting for the big news, but it’s been worthwhile

Yesterday’s Q4 call lasted 20 min followed by two questions - one of which by yours truly - and even that slightly unnecessary. One reason is that it’s

Controlling shareholder Sokrates Kokkalis has acquired an incremental ~4.8% of shares in Intralot on the Athens Stock Exchange, taking his personal share of

Please refer to our unchanged analysis here.

It’s been a long and profitable ride with Intralot. But as indicated in our last mail, we have been discussing exiting

Please refer to our unchanged analysis of Intralot here.

The gold rush out west has made many a fortune, but for many it turned into a matter of all or nothing. Once again, Intralot have lost their