- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Nidda: UPDATE 5th September 2022

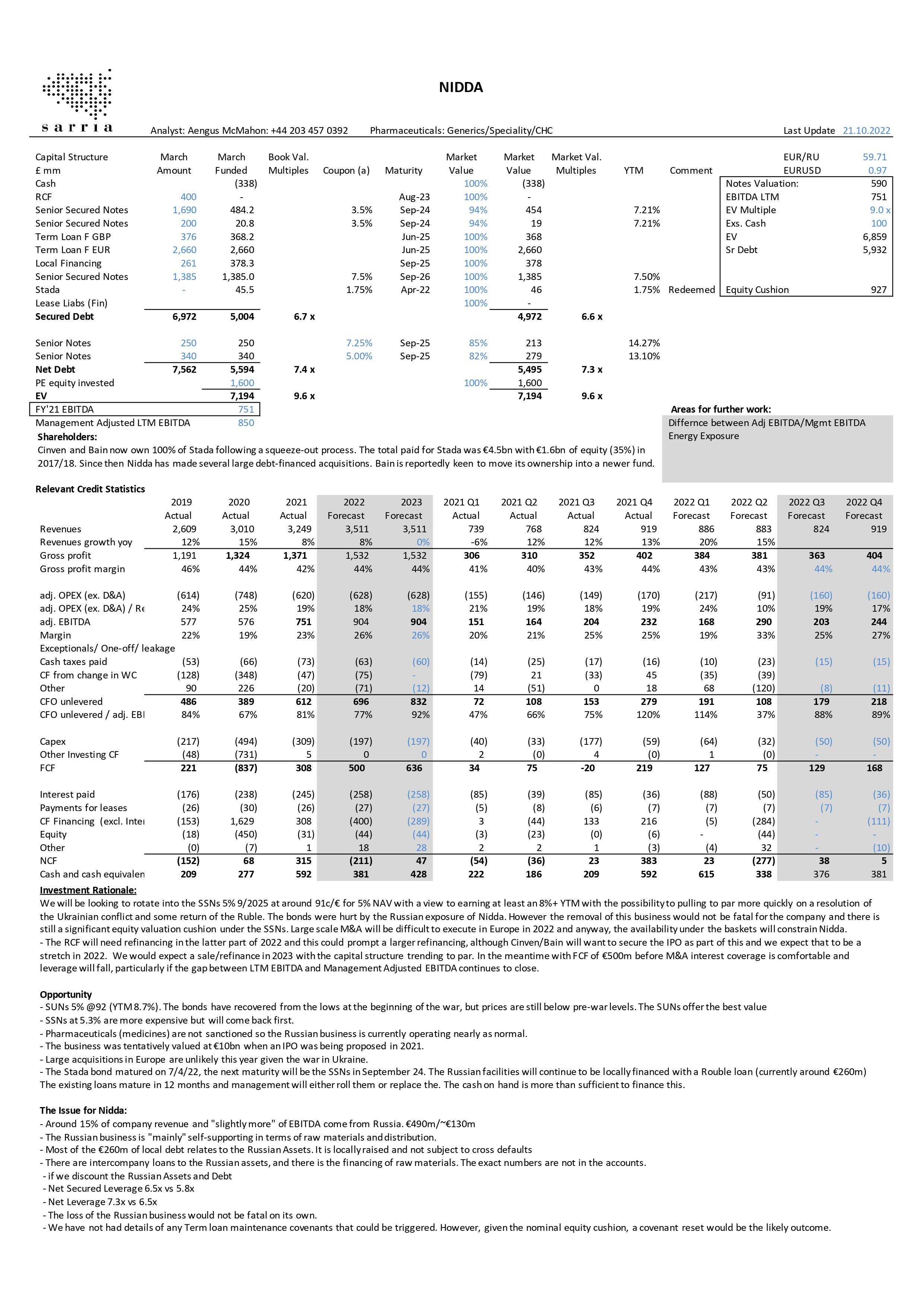

Nidda: Introduction, Capital and Legal Structure 11/04/22

Introduction, Capital and Legal Structure 11/04/22

Russian Exposure and Forecast 11/04/22

Investment Discussion 11/04/22

The removal of the Russian business, alongside a good set of 23Q3 results, opens the way for Bain/Cinven to dispose of Nidda. Another PE buyout seems

Moving the Russian business outside the Restricted group will allow for a cleaner sale/IPO process. The timing of the announcement points to imminent

The sale/IPO might be back on with banks pitching debt packages for a potential buyout. The valuation of €10bn is in line with the previous IPO

We are not surprised that Bain and Cinven are eyeing a sale of Stada. A potential IPO was on the table before the conflict in Ukraine broke out. With the war

Aengus is back tomorrow to comment fully on Nidda, but the Q2 numbers show continued growth coupled with improving EBITDA margins driving a 12% increase in EBITDA. This has led

Please find our unchanged analysis here.

As Nidda/Stada has completed its amend and extend exercise, we are rotating our capital into a more attractive opportunity. The 2025 bonds we

Nidda beat our top-line forecast by €30m, generating €1,041m, and a Gross Margin of 46% was above our forecast. However, higher

The remaining €247.2m 3.5% 24 SSNs will be repaid by Nidda on 22 May 23 using the €250m TL G announced a week ago. Our model had an interest cost of

Nidda has now completed its amend and extend exercise, and between the term loan and cash on hand, the remaining €400m of 3.5% of 24 SSNs can be

Moody’s downgrade of Nidda’s bonds reveals a potential wrinkle to maturity management operations. However, from the issuer's perspective, shifting maturities is about protecting the

Nidda’s liability management exercise announced yesterday should significantly reduce its 2024 maturities leaving just €400m of SUNs in 2025 to refinance (if no

The virtual closure of the high-yield market is causing issuers and investors to fret about 1) When will the high-yield market re-open for highly leveraged names, and 2) the coupons

Q322 results were better than our model due to top-line growth above the market (FX Adjusted). Gross margin improvement of 100bp was aided by a

Please find our updated analysis here.

Pushing maturities out to September 2026 gives Nidda time to consider an IPO in 2024 without facing a maturity hurdle. The exchange offer completed yesterday is

We’ve had a 40min discussion on Nidda this morning and have put the relating video on the website.