Adler / Gerresheimer - An "Artist's" Impression

All,

Please find our slightly updated analysis here.

Naturally, the deeper one digs, the more frequently the same familiar parties pop up. In the case of Gerresheimer this seems to be no different. What’s perplexing is of course the well-documented closeness of the vehicles and how the transaction apparently fails to return some €58m of cash to Adler, but having done the work, we are still not quite sure of some of these points.

Location of the risk:

- On the asset side, there has recently been only one transaction: the return of Gerresheimer to Brack. Brack itself had sold the asset to Cevdet Caner’s brother in law for payment of €75m and the transfer of liabilities. The recent succession of similarly sized transactions - LEG paying €75m upfront to Adler for Brack and Aggregate selling their Corestate exposure for the same amount and effectively at the same time suggests that both stand in connection with the reversal of the transaction. Adler need liquidity, but €75m won’t make the difference now.

- We conclude therefore that at least €75m of the risk have always been effectively on Aggregate’s books. But Aggregate had bought its 20% stake in Corestate for €125m in H121 in return for its contribution of Aggregate Financial Services (AFS), the entity that had arranged the Gerresheimer refinancing and was continuing to arrange more deals for Aggregate and which is now called Corestate Bank Bank.

- So did Aggregate just take a loss in Corestate of €50m? The transfer price appears to be in line with the latter’s share price development, but the relative size of the players suggests that would be like the tail wagging the dog.

The 2020 refinancing:

- We are not certain as to the reason of the financing or if it even resulted in a cash transfer from Aggregate / Corestate Bank Bank to Joseph Schrattbauer’s entity. In our “Artist’s” Impression below, we are assuming a cash transfer, but mostly because we do not know better. There are some €58m of debit transactions unexplained and it could have been cash for the development of the asset. The other positions on the Schrattbauer BS we are inferring from what we have observed as unwind on the Adler Real Estate books and they largely match with the 2016 sale to Schrattbauer, so the debit does not seem to have unwound any of those.

- In their Q3 accounts Adler are not referring to any receipt of cash along with the return of the asset, but that could have been handled in a different way or Adler simply did not spell it out.

- We therefore simply have no conclusive evidence that any material cash ever entered Schrattbauer’s vehicle, nor that the vehicle burnt/lost/transferred away any cash from the project.

The Loser:

- Adler have written off only just over half the equity they realised in the initial transfer to Schrattbauer. We note that this is incidentally the same amount for which Aggregate bought their stake in Corestate with the transfer of AFS at the same time they crossed thresholds in Adler. Overall, however, Adler do not seem to have lost money on the Gerresheimer deal, unless we find another correction in the Q4 accounts.

- Schrattbauer does not seem to have put much cash into the vehicle in the first place. So it is unlikely the bucket will have stopped with him.

- Aggregate and Corestate are difficult to tell apart in our analysis. Because Aggregate seem to have been the brains behind much of the transaction, we assume that that’s where further losses - ifs any - may have had to be recognised.

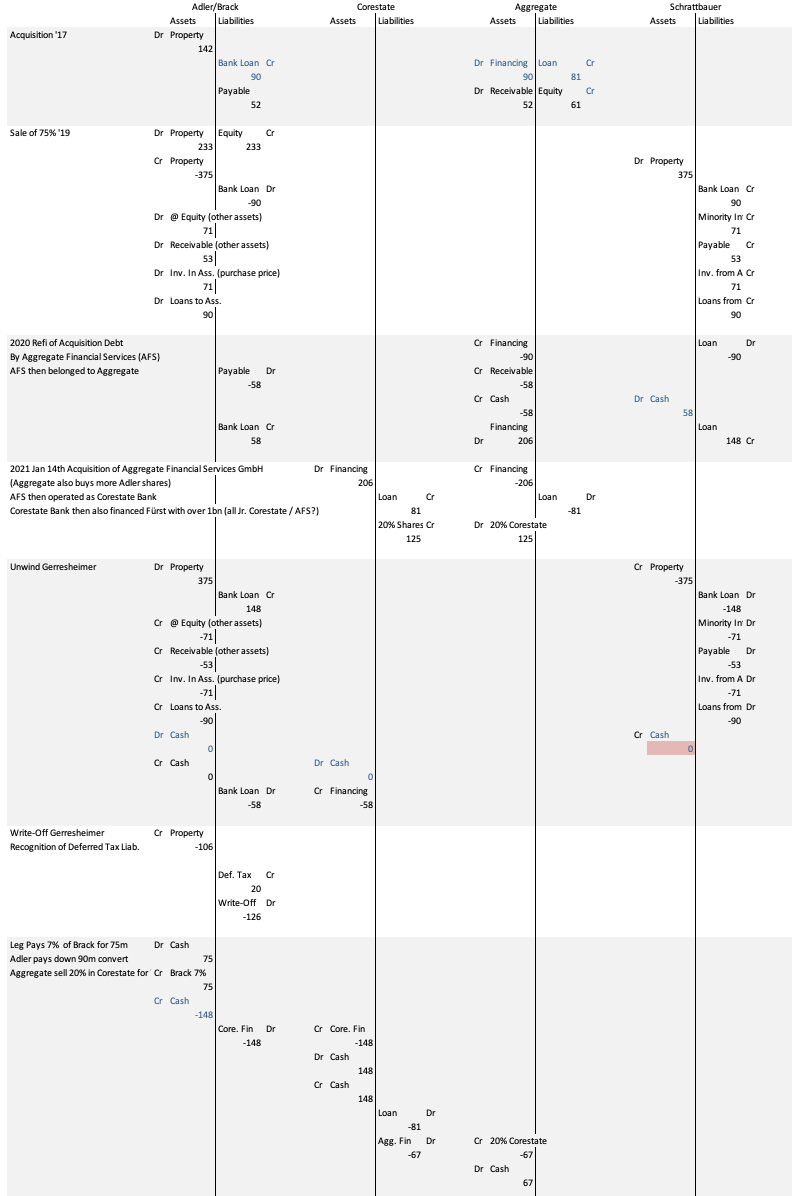

Gerresheimer: An “Artist’s” Impression:

- The below graph is intended to serve as a basis for discussion only. It aims to retrace the various transactions over the last two years under the assumption that the bucket stops with Aggregate. The “Zero” for the cash figure on the Schrattbauer vehicle upon return of the asset to Adler merely serves to illustrate the loss of value in Aggregate’s stake in Corestate. Naturally, there are many other reasons that have contributed to a lower valuation today.

Other news:

- A fund named Argonaut Capital has filed a complaint with Bafin on Adler’s calculation of the proceeds from the Brack sale to LEG, which were materially lower than the price LEG had published and lower than its previous guidance Yet management maintain that equity proceeds are unaffected at €800m. Adler’s own explanation of the difference in its call on December 2nd remained somewhat vague. The fund is running a short position and alleges market abuse.

- We note that Adler management in their vague bridge discussion mentioned “working capital adjustments” among the reasons for the difference. Because the Gerresheim project is not a build2own project, it should - despite ARE’s classification as long-term Investment Property asset - feature as inventory on LEG’s possibly more conservative books.

- Again, the initial advance of 7% of Brack may be used to clean things up ahead of a transfer to LEG.

Positioning:

- We are maintaining our position of 2.5% of NAV in the Consus 22s. Filings such as the above have been the main reason for our caution about taking some of the Adler Group equity and we are expecting more such events going forward.

- None of the above amounts to anything on its own. However, if any of us can help locate the risk and if that helps us observe any further transactions surrounding this asset, then perhaps that will help us manage risk from a possible contagion at Aggregate, Corestate or other assets with similar background at Consus.

Please let us know if you have any information or views.

Wolfgang

T: +44 203 744 7003