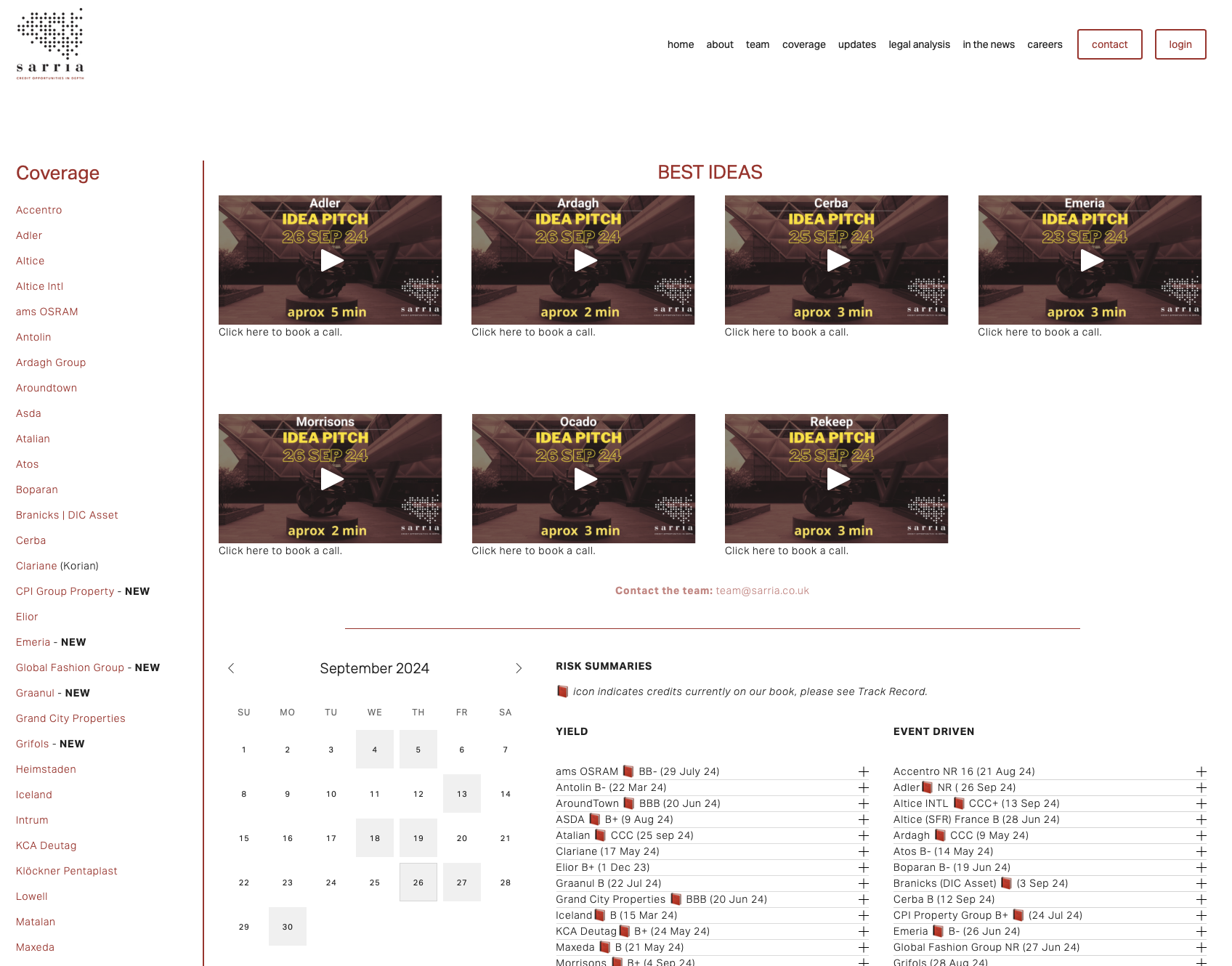

LONG Idea - video

- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Capital and Legal Structure 24/11/22

Industry and Company 24/11/22

Model 24/11/22

Investment Discussion 24/11/22

The senior appointments made at Morrisons show CEO Rami Baitiéh stamping his authority on the business. Revamping the

The company has an equal pay case similar to ASDA. If the workers are successful, we estimate the potential costs of £150m -

The competitiveness in the UK Grocery sector is not going away. ASDA is looking to cement its position, while Morrisons is looking to win back customers

Morrisons pivoting towards online order fulfilment via store picking is a negative for Ocado but partly reflects Morrison’s need to utilise its largely

The ransomware attack on a supply chain IT provider will have a short-term impact, and not all costs will be recoverable. We expect the cash cost to

The potential closure of the Rathbones business surprises us, but selling a business where Morrisons is almost the sole customer may be

A sale of Morrisons' own label bread business would bring in £75m - £85m in our analysis. Not insignificant but not a

The loss of a senior executive to Morrisons before he even started work at ASDA is not a good look. However, the relative stability of Morrisons is

The refinancing is positive across the Morrisons debt stack. The new £1.2bn TLB will push much of Morrison’s maturities to November 2030 for

We remain positive about Morrisons. Q3 revenue growth was in line with our forecast, and whilst EBITDA margins were lower

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

The £370m proceeds from the ground rent deal will be used to repay debt. The transaction will layer the SSNs, as the rents will be structurally

Please find our slightly updated analysis here.

Despite continuing cost headwinds, we continue to like the SUNs as we expect Morrisons market share to stabilise and profitability to grow over the

The pay equality claim by ASDA staff is in court in early September, and the successful claim by Next staff will weigh on ASDA bonds. However, the case has

Settling the dispute with logistics staff will help Morrisons avoid disruption and empty stores, but will not aid the cost-cutting plans for

CEO Rami Baitiéh has highlighted the need for operational improvements at Morrisons. We are not hearing an alarm bell yet, but losing two

Tesco continue their market share gain, adding a further 52bps of market share as Tesco continue to see customers switch from M&S and Waitrose. More importantly,

The recent strikes at Morrisons did impact deliveries, and most staff at the two distribution centres (of seven) took part. The industrial action is

The disruption caused by the three-day strike at two (of seven) Morrisons Distribution centres will only have a small impact on results. Even if the

The €1bn buyback surprised us as we had expected Morrisons to use the cash to repay Term Loans. We will continue to hold both the SSNs and the SUNs. We are not rushing to

Bouygues, will want to maintain its infrastructure at the forecourts sold by Morrisons. The suit will likely cost Morrisons something to make it go away, but

Cost-cutting efforts at Morrisons are seeing some staff pushback. The impact will be limited as the action impacts two of seven hubs

Please find our updated analysis here.

Morrisons are prioritising market share over profits. As a result of £75m of synergies being used to reduce prices / passed on to the consumer, our Q1 EBITDA was a significant miss (£70m). We have reviewed our model to rectify this. Reducing the

Price support will continue to drag on margins in 2024. The latest plan to price match Aldi in certain products is an effort by Morrisons to regain

The arrival of Rami Baitieh as CEO has reduced the importance of David Lepley, and the timing of his departure is

Selling the forecourt business is a positive for leverage at Morrisons, but as we said yesterday, the reduction is less than we expected. Also, the amount of cash Morrisons will receive is still uncertain. The £1.95bn in cash includes a £650m Preferred Equity piece

Morrisons is getting less cash than we hoped from the sale of its UK forecourt business to MFG. However, the transaction will drop leverage by a turn

Executing the sale of Morrisons forecourt business will reduce leverage significantly, and today’s headline points to a deal being agreed by the end of

The latest price cuts demonstrate that price support is still required for Morrisons and its competitors. At £15m, this is a modest investment